Biden blocks Trump-era gig-worker rule

The Biden administration is blocking a Trump-era regulation that would have made it easier to classify gig workers and others as independent contractors, a policy that had been sought by companies such as food-delivery and ride-sharing services.

The Labor Department said Wednesday it is nullifying a rule it completed in early January that sought to make it more difficult for a gig worker to be counted as an employee under federal law. Having status as an employee, rather than a contractor, means those workers are covered by federal minimum-wage and overtime laws.

Employees are also better positioned than contractors to organize into labor unions. The Biden administration has made creating union jobs a priority.

The Labor Department is acting this week to block the rule before it was implemented Friday, following a common practice of presidents of different parties undoing the prior president’s pending rules early in a new administration.

Nullifying the Trump rule maintains the decades long status quo, which has largely allowed app-based services to not count drivers and other providers as employees. But Wednesday’s action removes an extra layer of assurance gig-economy companies had sought as a way, they said, to modernize labor laws.

The Labor Department isn’t planning to offer new regulations for independent contractors in the near future, said Jessica Looman, principal deputy administrator for the department’s Wage and Hour Division.

"We are going back to the decade’s old analysis and we really feel that this is the space where we can best protect workers," she said on a call with reporters. "When it comes to digital workers...we want to make sure that we continue to look at their needs, how they are interacting with their individual employers and whether or not they have the protections of the Fair Labor Standards Act."

By blocking the Trump rule, the Labor Department will continue to use its previous regulation to enforce the Fair Labor Standards Act, which was enacted in 1938. While Wednesday’s action doesn’t immediately change how gig workers are classified, it leaves ambiguity about how a Depression-era law will be applied to a smartphone economy. Ms. Looman said the department will look for opportunities to enforce existing laws, especially as they apply to lower-wage workers.

She said Wednesday’s announcement should not dramatically change how the department regulates app-based services but said the department is engaging with those companies and others about labor-law enforcement.

"The fact that we are moving and are embracing a pro-worker position doesn’t mean that we’re anti-employer," Ms. Looman said.

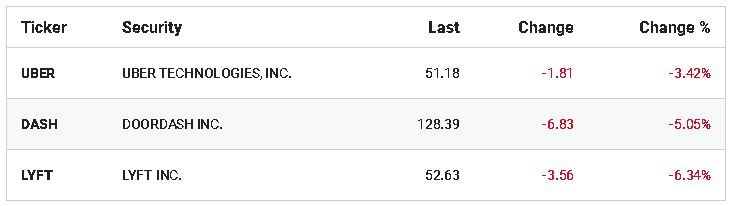

Earlier this year, Uber Technologies Inc. applauded the Trump rule, saying it recognized the flexibility gig workers sought and called the previous regulation—which now is remaining in place—outdated. Trump administration officials said their rule made it easier for Americans to be self-employed and set their own hours.

The Trump rule, announced on Jan. 6, was to be implemented on March 8, but the Labor Department delayed it from going into effect until Friday, as part of President Biden’s broader freeze on pending regulations.

Labor Secretary Marty Walsh, in an April interview with The Wall Street Journal, said that legitimate independent contractors are an important part of our economy, but the Trump-era rule made it too easy to deny workers employee status.

"We’ve seen employers are increasingly misclassifying their workers as independent contractors in order to reduce labor costs and take a lot of protections away from workers, including minimum wage and overtime," Mr. Walsh said.

The back-and-forth contractor regulations are in part a response to California rules applied to gig companies.

In November, voters in California exempted Uber, Lyft, DoorDash and others from a state law that would have forced them to reclassify their drivers as employees, eligible for broad employment benefits. While the exemption allowed the companies to preserve their business models in the most populous U.S. state, they did concede some new benefits such as health insurance for drivers who worked 15 hours or more a week, occupational-accident insurance coverage and 30 cents for every mile driven.

At the time, the companies said they would lobby to make this model—flexibility for drivers with limited benefits—the national standard.