Hon Fahie: Gov’t ‘definitely looking into’ 7% remittance tax

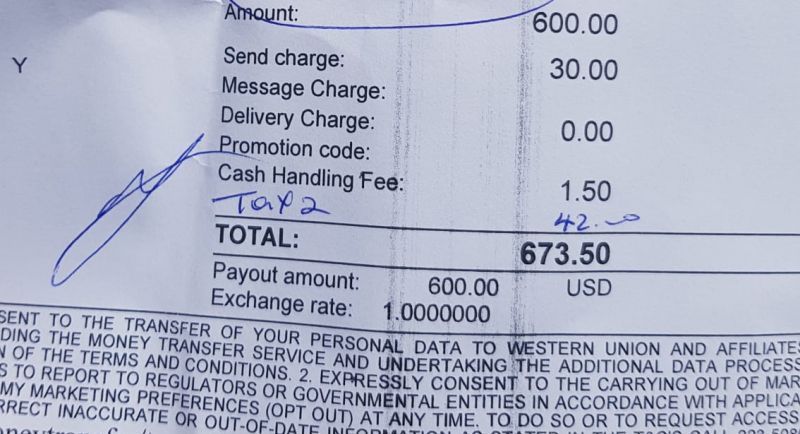

The tax dubbed the “Financing & Money Services (Amendment) Act 2020”, was passed on April 17, 2020, in the House of Assembly and subsequently assented to, has since reeled in millions on a yearly basis.

During a press conference on January 28,

2022, Premier Andrew A. Fahie (R1), right, was asked by reporter Zan

Lewis, left, about 'dropping' the 7% tax on money transfers in the

territory.

During a press conference on January 28,

2022, Premier Andrew A. Fahie (R1), right, was asked by reporter Zan

Lewis, left, about 'dropping' the 7% tax on money transfers in the

territory.

‘We are still looking into it’- Premier

During a press conference on January 28, 2022, the Premier was asked by reporter Zan Lewis about dropping the tax.

“A few months ago you said that the Government is looking into the 7 percent with the whole money transfer services. That sounds good. Where are you with that…you gonna drop it?” Mr Lewis asked.

Premier Fahie replied: “We are still looking into it and we will let you know soon.”

“Why you taking so long?” Mr Lewis persisted.

Honourable Fahie reiterated his assurance that the issue was being looked at.

“We are definitely looking into it. That’s a very serious statement I am making,” Premier Fahie added.

There have been mixed reviews on the tax,

with some saying too much money goes out of the economy while some

believe that the tax percentage is too high and it is unfair that the

Government decided to introduce the tax during the pandemic and is

collecting taxes from monies that have already been taxed.

There have been mixed reviews on the tax,

with some saying too much money goes out of the economy while some

believe that the tax percentage is too high and it is unfair that the

Government decided to introduce the tax during the pandemic and is

collecting taxes from monies that have already been taxed.

Mixed reviews on 7% tax

Government had said the tax will be divided and distributed towards infrastructure, education, the seniors, fishing and agriculture, as well as the land bank and first-time homeowners’ initiative etc.

Since its introduction, residents of the territory have utilised other avenues to send remittance such as wire transfers.

There have been mixed reviews on the tax, with some saying too much money goes out of the economy while some believe that the tax percentage is too high and it is unfair that the Government decided to introduce the tax during the pandemic and is collecting taxes from monies that have already been taxed.

“I stand by this initiative, this is not a tax on the poor,” Premier Fahie said during the Seventh Sitting of the Second session of the Fourth House of Assembly (HoA) on April 17, 2020, citing that the territory should get a percentage of millions sent annually through money transfer services.

Opposition Members; however, shared a difference in opinion, with the majority saying the fee will cripple the poorest of the working class in the Territory, especially amidst the COVID-19 crisis.