Inflation has not peaked, oil prices will continue to rise: Energy expert

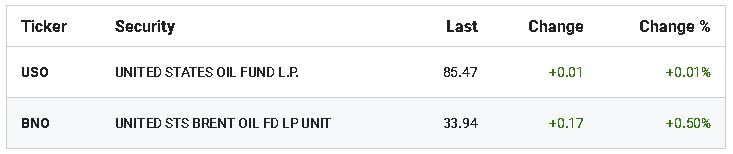

Lipow made the arguments on "Mornings with Maria" on Tuesday morning as oil prices traded higher with Brent crude futures for July rising about 1.6% to $123 a barrel and U.S. West Texas Intermediate crude futures for July delivery gaining about 3% to around $118 a barrel.

The higher oil prices come after EU leaders agreed the day before to cut around 90% of all Russian oil imports over the next six months. Europe relies on Russia for 25% of its oil and 40% of its natural gas.

"What this means is higher oil prices are ahead because this impacts about 2.3 million barrels a day of crude oil and another 1.2 million barrels a day of refined products," Lipow told host Maria Bartiromo.

"And as the world scrambles for alternative supplies, it means that oil prices have to go up in order to create additional demand destruction to get us back in balance."

Gas prices are also elevated and have been hitting records, standing at a fresh record of $4.62 a gallon on Tuesday, slightly higher than the day before and an increase of 44 cents compared to the prior month, according to AAA.

Lipow forecasted that "we could start approaching $5 a gallon if crude oil prices continue to rise."

He also argued that he doesn’t think inflation is peaking "because not only do we have higher gasoline and diesel prices, we have significantly higher natural gas prices, which are nearly triple what they were at this time a year ago."

"That’s going to impact everything from electricity to people’s hot water heaters to cooking and so forth," Lipow explained. "So I think that inflation is going to continue over the next few months."

Earlier this month it was revealed that inflation cooled on an annual basis for the first time in months in April, but rose more than expected as supply chain constraints, the Russian war in Ukraine and strong consumer demand continued to keep consumer prices elevated.

The Labor Department said earlier this month that the consumer price index, a broad measure of the price for everyday goods including gasoline, groceries and rents, rose 8.3% in April from a year ago, below the 8.5% year-over-year surge recorded in March. Prices jumped 0.3% in the one-month period from March.

Those figures were both higher than the 8.1% headline figure and 0.2% monthly gain forecast by Refinitiv economists.