UK BANKING CHANNEL FORECAST: How shifting consumer habits and the coronavirus pandemic are shaping future usage of and informing banks' investments in branches, digital and mobile banking, ATMs, and call centers

The UK banking space is experiencing a push toward digital channels — driven by branch closures, consumer preference for digital, declines in cash usage, and changes brought about by the coronavirus pandemic.

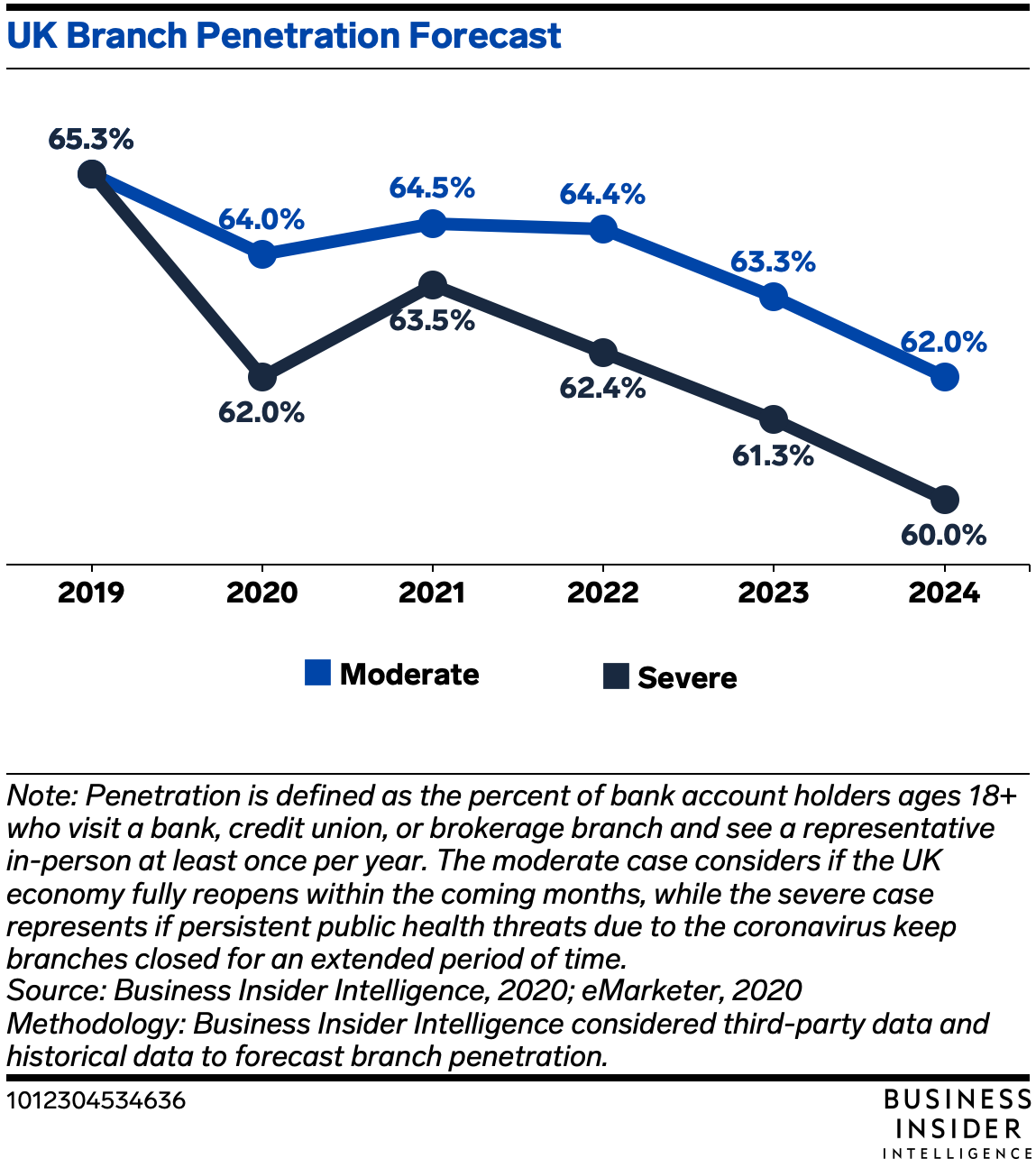

The pandemic is accelerating existing usage trends — like lowered cash usage — in some channels while highlighting the need for digitization in other areas. And the magnitude of the coronavirus pandemic is going to impact the lasting effects it has on changes in banking channels: If it takes a moderate course and the UK economy fully reopens within the coming months, shifts will be less significant than if the pandemic takes a severe course, where persistent public health threats due to the coronavirus will keep branches closed for an extended period.

Business Insider Intelligence

Business Insider Intelligence

Banks are being forced to reevaluate their investments in different banking channels as consumers gravitate toward digital. Shifts in penetration for branches, digital banking, smartphone banking, ATMs, and call centers provide a lens into where the UK banking industry will be in the next five years.

This should inform banks' decisions about what areas to invest in more heavily going forward to drive customer acquisition and retention.

For channels including branches, ATMs, and call centers, penetration is defined as the percent of UK bank account holders ages 18+ who access those channels at least once per year, while for smartphone banking and digital banking, we define penetration as the percent who use those channels at least once per month.

In The UK Banking Channel Forecast report, Insider Intelligence forecasts the growth or decline over the next five years of five key banking channels in the UK: branches, digital platforms, smartphones, call centers, and ATMs. We identify the drivers behind the trajectory of each channel's penetration, including changes to consumer behavior or advancements in technology.

We also highlight how the coronavirus pandemic and its subsequent lockdown period has affected each of these growth trajectories in the immediate and longer term. We include penetration forecasts for two possible pandemic scenarios, a moderate one in which the UK economy fully reopens within the coming months, and a severe one where persistent public health threats keep branches closed for an extended period.

The companies mentioned in this report include: Barclays, HSBC, Revolut, Lloyds, Monzo, Nationwide Building Society, NatWest, Royal Bank of Scotland, Starling, and TSB.

Here are some key takeaways from the report:

* Branch penetration has been declining as banks have scaled back their physical footprints to rein in operating costs. Temporary closures during the pandemic are accelerating that decline and could cause long-term behavioral shifts among customers from physical to digital channels.

* The rise of neobanks is forcing incumbents to step up their digital offerings, and the pandemic has made digital and smartphone banking channels the primary points for customers to access their finances — driving usage of these channels up out of convenience.

* There has been a years-long shift away from cash in the UK, and as digital channel penetration increases, consumers will be even less reliant on ATMs. But the shrinking availability of free ATMs has sparked controversy from regulators and consumer advocates working to protect cash-reliant consumers.

* Call center penetration will be sustained by the continued preference for human assistance. Call centers became the front line of communication between customers and banks during the onset of the pandemic — and they were inundated with requests for payment holidays.

In full, the report:

* Forecasts where penetration in each banking channel — branch, ATM, call center, digital, and smartphone — will stand through 2024.

* Explores the factors leading to the uptick or decline in usage of each banking channel.

* Considers the current and ongoing role of the coronavirus pandemic on the usage of these channels.

* Highlights notable areas of investment for banks based on usage trends.

* Recommends how banks can drive the most value out of their investments in each channel.