VI Gov’t launches COVID-19 Income Support Programme

Deputy Social Development Officer and Programme Lead Coordinator, Ms Stacie T. Stoutt-James stated that the programme is a temporary cash transfer initiative that will offer support to those who have experienced a loss, reduction, or termination of employment due to the pandemic.

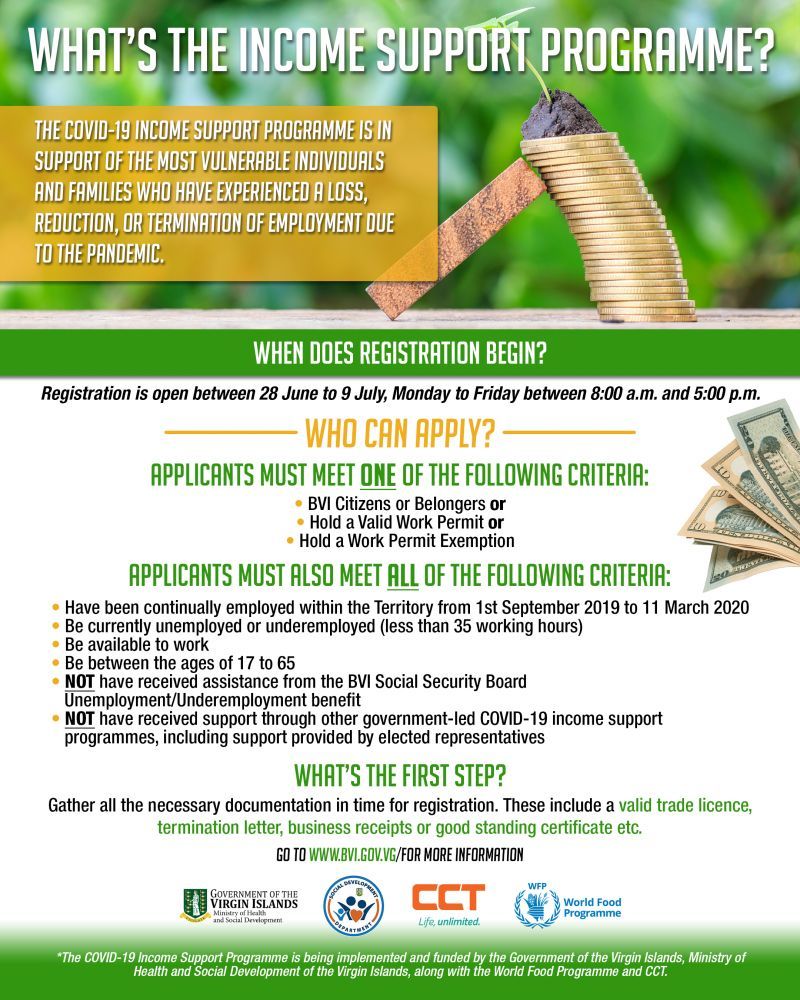

Registration opens June 28, 2021

Ms Stoutt-James, in a Government Information Services (GIS) press release on June 22, 2021, said: “We recognise that persons may need specific assistance so we have offered a few options in this regard. We would like that when registration opens on June 28, that persons have all the necessary documentation ready and at hand so they can either WhatsApp to assigned numbers, email or upload the same to complete their applications in a timely manner and incomplete applications will not be accepted.”

The COVID-19 Income Support Programme will offer two registration options, either through the VI Government’s Website or by telephone that will be open from June 28 to July 9, 2021, Monday to Friday, between 8:00 a.m. and 5:00 p.m. The registration number will be forth coming in the coming days.

The COVID-19 Income Support Programme is

being implemented by the Social Development Department under the

umbrella of the Ministry of Health and Social Development, along with

the World Food Programme and Caribbean Cellular Telephone (CCT).

The COVID-19 Income Support Programme is

being implemented by the Social Development Department under the

umbrella of the Ministry of Health and Social Development, along with

the World Food Programme and Caribbean Cellular Telephone (CCT).

Who are eligible?

Eligible persons must be VI Citizens, Belongers or valid Work Permit or Work Permit Exemption holders. In addition, applicants must meet the following criteria which is to be continually employed within the Territory from September 1, 2019 to March 11, 2020; be currently unemployed or underemployed which is less than 35 working hours; be available to work; be between the ages of 17 to 65; have not received assistance from the BVI Social Security Board Unemployment/Underemployment benefit; and have not received support through other government-led COVID-19 income support programmes, including support provided by elected representatives.

Programme partners

The COVID-19 Income Support Programme is being implemented by the Social Development Department under the umbrella of the Ministry of Health and Social Development, along with the World Food Programme and Caribbean Cellular Telephone (CCT).

The programme also includes support from the UN COVID-19 Response and Recovery Fund, the United Nations Resident Coordinator Office for Barbados and the Eastern Caribbean Multi-Country Office.

Documents to provide

Applicants should submit the Termination of Service/Lay-off forms from their previous employer. If the form is not available, applicants should submit a termination letter or note including the contact information of the employer.

Self-employed applicants must be the only employee on the business payroll and not employ other persons. Self-employed applicants must submit a valid trade licence, in addition to any two of the following: the last three business receipts which demonstrate purchases related to their business from February to March 2020; any relevant association membership letter (such as BVI Chamber of Commerce); or any other documentation which demonstrates that they’ve worked in the relevant sector as a self-employed person (Certificate of Good Standing, such as SSB Certificate or Inland Revenue Certificate).

Informal workers are self-employed persons who are not on payroll, are not taxed and do not pay social security contributions. To be deemed eligible, applicants need to submit a notarised letter from a pastor or an elected representative indicating the type of business and period of operation.

Deputy Social Development Officer and

Programme Lead Coordinator, Ms Stacie T. Stoutt-James stated that the

COVID-19 Income Support Programme is a temporary cash transfer

initiative that will offer support to those who have experienced a loss,

reduction, or termination of employment due to the pandemic.

Deputy Social Development Officer and

Programme Lead Coordinator, Ms Stacie T. Stoutt-James stated that the

COVID-19 Income Support Programme is a temporary cash transfer

initiative that will offer support to those who have experienced a loss,

reduction, or termination of employment due to the pandemic.

CCT donates 10 cellular phones to programme

Ms Stoutt-James thanked all the officers involved for the level of commitment they have already demonstrated, highlighting CCT Global Communications for the donation of ten (10) cellular phones with dedicated numbers which will be used in the registration process.

Eligible persons are encouraged to apply within the registration window and a dedicated registration team will be available to assist with the application process which will include Spanish-speaking operators. For more information, potential applicants should monitor the Government of the Virgin Islands portal - www.bvi.gov.vg, and follow the Government of the Virgin Islands on Facebook.

The Government of the Virgin Islands has already provided stimulus grants, both to businesses and individuals and food supplies during this pandemic. Other assistance has come in the form of a periodic waver in water bills, assistance with payment of electricity bills and reduced or delayed port fees and stamp duty waivers.