Wealthiest Americans including Elon Musk and Jeff Bezos 'paid no income tax'

President Joe Biden is facing calls to introduce a wealth tax following a report alleging America's richest executives, including Elon Musk and Amazon's Jeff Bezos, have avoided paying income tax - some over several years.

ProPublica, the not-for-profit investigative journalism organisation, said its findings showed the tax bills were especially low when compared with their soaring wealth and other assets.

It calculated the wealth of the 25 richest Americans collectively jumped by $401bn (£283bn) from 2014 to 2018.

They paid, ProPublica said, $13.6bn (£9.6bn) in federal income taxes over those years - equal to just 3.4% of the increase in their overall fortunes.

Amazon founder and departing CEO Jeff Bezos.

Amazon founder and departing CEO Jeff Bezos.

This is down to tax strategies which are perfectly legal.

Tax avoidance measures can include reductions for charitable donations or by taking no wages - taxed at up to 37% - and benefiting instead mainly from investment income at a usual lower rate of 20%.

The report alleged that Amazon founder and departing CEO Jeff Bezos paid no income tax at all in 2007 and 2011.

It was the same for Tesla and Space X founder Elon Musk in 2018.

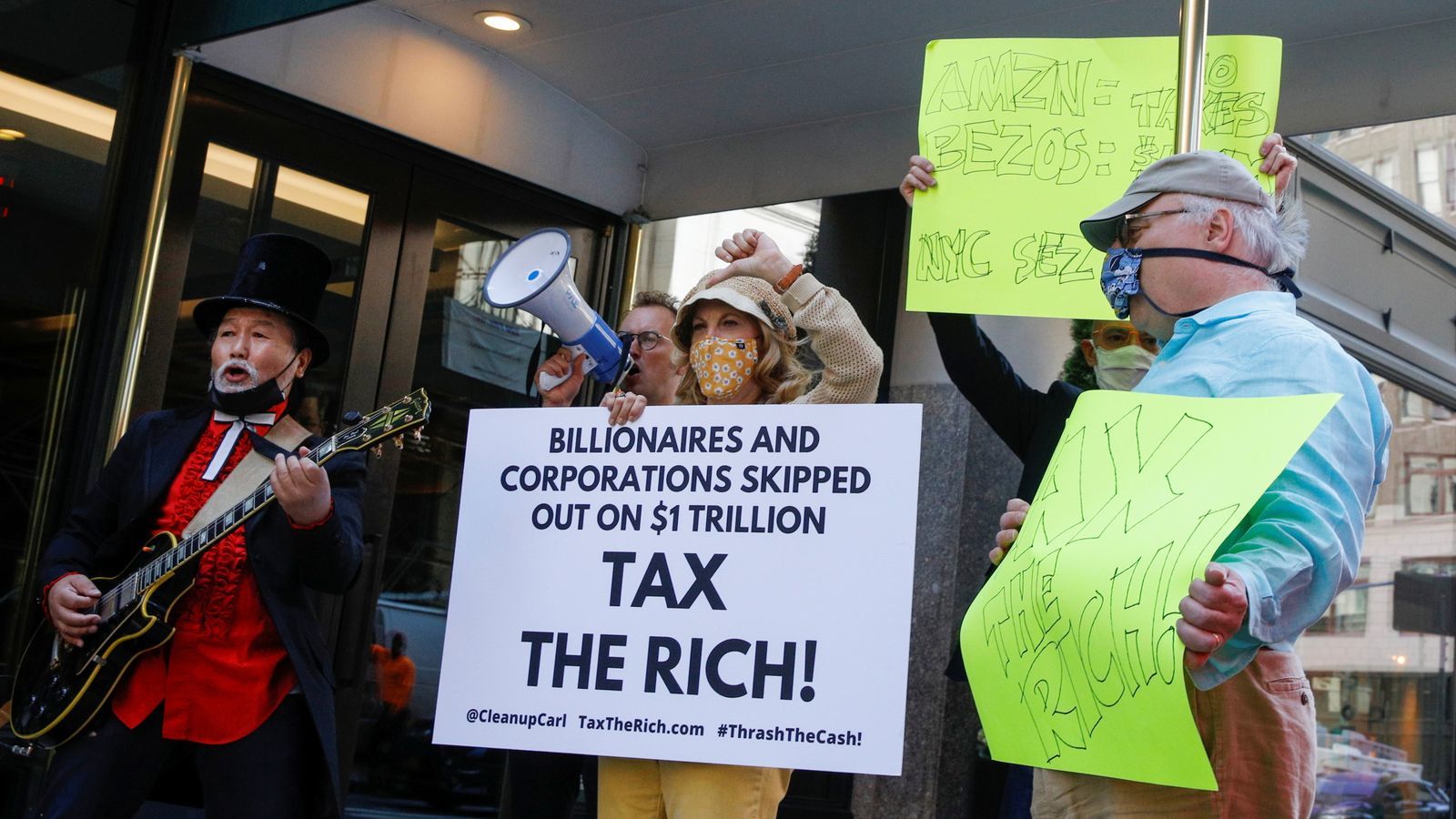

Members of the Patriotic

Millionaires hold a federal tax filing day protest outside the apartment

of Jeff Bezos, to demand he pay his fair share of taxes in May

Members of the Patriotic

Millionaires hold a federal tax filing day protest outside the apartment

of Jeff Bezos, to demand he pay his fair share of taxes in May

The analysis showed financier George Soros - known by some as the man who broke the Bank of England because of a short sale on sterling that netted him $1bn in 1992 - went three straight years without paying federal income tax.

A spokesman for Mr Soros, who has supported higher taxes on the rich, told ProPublica that he had lost money on his investments from 2016 to 2018 and so did not owe federal income tax for those years.

Mr Musk, the AP news agency reported, responded to ProPublica's initial request for comment with a punctuation mark "?''.

America's tax system is under greater strain as Mr Biden embarks on a series of spending sprees, including a massive $2.3trn infrastructure programme, at a time when government borrowing has rocketed to pay for the 1COVID1-19 pandemic.

Financier George Soros - known by some as the man who broke the Bank of England

Financier George Soros - known by some as the man who broke the Bank of England

Democrat supporters used the publication of the ProPublica papers to demand the president introduce a tax on wealth rather than inflict more financial pain on ordinary households.

Senators Elizabeth Warren and Bernie Sanders are among the cheerleaders.

Ms Warren tweeted on Tuesday: "Our tax system is rigged for billionaires who don't make their fortunes through income, like working families do.

"The evidence is abundantly clear: it is time for a #WealthTax in America to make the ultra-rich finally pay their fair share."

Mr Biden has previously ordered a crackdown on offshore tax evasion amid estimates the US government loses up to $120bn annually from individuals and corporations cheating the system.

However, a Senate finance committee hearing was told earlier in the day by the IRS Commissioner Charles Rettig that his team was "outgunned" when it came to enforcement.

The G7 group of wealthy democracies, which includes the US and Britain, agreed to support a global minimum corporate tax rate of at least 15% to deter multinational companies from avoiding taxes by stashing profits in low-rate countries.