Boeing to Cut 7,000 More Jobs in Jet Market’s ‘New Reality’

An additional 7,000 jobs are slated for elimination by the end of next year, bringing the total cuts made through retirements, attrition and layoffs to 30,000 people, Boeing said in an email Wednesday after reporting earnings. In all, the planemaker is cutting 19% of its pre-pandemic workforce after an unprecedented collapse in air travel and jetliner sales.

“We’re aligning to this new reality by closely managing our liquidity and transforming our enterprise to be sharper, more resilient and more sustainable for the long term,” Chief Executive Officer Dave Calhoun said in a statement.

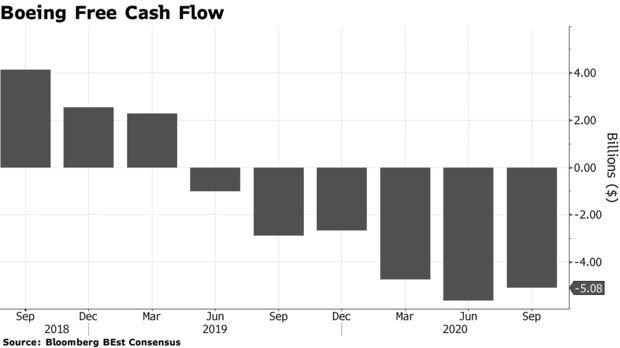

Once a prodigious cash generator, Boeing is now carefully monitoring its liquidity and soaring debt while navigating the deep slump in air travel and working with regulators to lift the Max’s flying ban. Boeing has burned through about $22 billion in free cash since March 2019, when regulators grounded the company’s best-selling jet after two fatal accidents.

Boeing fell 2.6% to $151.25 at 10:12 a.m. in New York amid broad market declines. The shares tumbled 52% this year through Tuesday, the biggest decline among the 30 members of the Dow Jones Industrial Average.

The Chicago-based company consumed about $5 billion in free cash during the third quarter, in line with analyst estimates and about $620 million less than a quarter earlier, when the pandemic forced the company to temporarily shut down much of its manufacturing. Boeing didn’t announce additional production cuts for its 787 and 737 Max, defying analyst expectations, and also got a $459 million income tax boost.

“While losing money and burning through over $5 billion in three months is hardly good news, at least it wasn’t worse than this,” Robert Stallard, an analyst at Vertical Research Partners, said in a report.

Max Plans

Calhoun and Chief Financial Officer Greg Smith will discuss Boeing’s results in a conference call at 10:30 a.m. Eastern time. They are expected to provide more detail on whether the company still expects to generate cash next year as it delivers hundreds of parked 737 Max.

Boeing reported an adjusted loss of of $1.39 a share, better than the average shortfall of $2.08 expected by analysts. Sales dropped 29% to $14.1 billion. Wall Street had predicted $13.8 billion.

Analysts are already looking ahead to 2021 and Boeing’s plans to clear its storage lots of around $16 billion of Max planes built during the grounding. Rising coronavirus cases are heaping additional pressure on airlines, which have leverage to scrap or renegotiate terms for Max jets with deliveries delayed more than a year.

Boeing’s affirmation of its plan to build 31 of its single-aisle aircraft each month by early 2022 “suggests either (1) confidence in getting customers to accept most of the 450 Maxes in inventory for delivery in 2021 or (2) willingness to take longer to pare the Max inventory,” said Cai von Rumohr, an analyst at Cowen & Co.

Airbus Production

Airbus SE, which reports earnings Thursday, has also been buffeted by the pandemic. But the European planemaker has seen fewer cancellations for its narrow-body jets than Boeing, and has even signaled suppliers to be prepared to raise production rates late next year if the market rebounds.

Questions are building as to how Boeing will counter a product lineup that includes Airbus A321neo jetliners -- particularly longer-range versions of the narrow-body jet that are capable of replacing wide-body aircraft on trans-Atlantic routes.

While Boeing provides more detail on its tactics for cutting costs to survive the pandemic, analysts are starting to question its longer-term strategy and vision for the market that will emerge on the other side of the crisis.

“We need to start thinking about how the company is going to look coming out of this,” said Ken Herbert, an analyst with Canaccord Genuity,