Budget Tax Increases Expected to Impact Workers' Pay

UK Budget imposes employer tax hikes, potentially reducing wage growth

The recent UK Budget has introduced significant tax hikes primarily targeting employers, with an expected impact on workers' pay.

A major component of the £40 billion tax increase includes a higher National Insurance rate for employers and a decreased threshold for these payments.

Influential think tanks, the government's independent forecaster, and Chancellor Rachel Reeves have warned that as businesses absorb these costs, pay raises for employees may be restrained.

The Resolution Foundation's James Smith emphasized this outcome, stating that the tax effectively targets working individuals and could lead to reduced wages over time.

Despite this, the government aims to prioritize economic growth, promising more disposable income for citizens by the end of the current parliament.

However, the rise in employer National Insurance Contributions (NICs) has drawn criticism, particularly from the Labour party, despite their previous pledge not to increase taxes on working people.

The Office for Budget Responsibility (OBR) forecasts indicate that 76% of the NICs increase will result in a constraint on wage growth and heightened consumer prices by 2026-27.

The OBR also projects modest household income growth, slightly exceeding past years, despite previous economic challenges such as Brexit and recent geopolitical conflicts.

Additional economic strain is highlighted due to an ageing population and escalating health service demands.

Real weekly wages are projected to see minor growth, only increasing by £13 over two decades.

The Institute for Fiscal Studies (IFS) predicts that larger firms, particularly those hiring lower-wage workers, will feel the greatest impact from higher employer NICs, potentially reducing job availability and generating less revenue than anticipated.

Paul Johnson, head of the IFS, anticipates further tax hikes and spending adjustments during the parliament's term unless economic growth improves significantly.

Opposition parties, including the Liberal Democrats, criticize the chancellor's measures as detrimental to jobs and local businesses, particularly in health and care sectors.

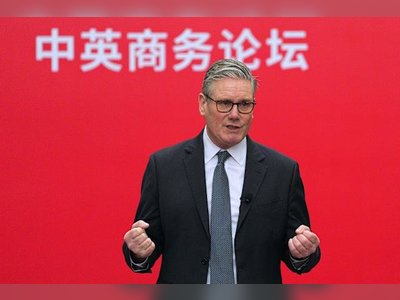

In defense, Prime Minister Sir Keir Starmer remarked that the government's approach is a responsible effort to stabilize the economy's foundation.

A major component of the £40 billion tax increase includes a higher National Insurance rate for employers and a decreased threshold for these payments.

Influential think tanks, the government's independent forecaster, and Chancellor Rachel Reeves have warned that as businesses absorb these costs, pay raises for employees may be restrained.

The Resolution Foundation's James Smith emphasized this outcome, stating that the tax effectively targets working individuals and could lead to reduced wages over time.

Despite this, the government aims to prioritize economic growth, promising more disposable income for citizens by the end of the current parliament.

However, the rise in employer National Insurance Contributions (NICs) has drawn criticism, particularly from the Labour party, despite their previous pledge not to increase taxes on working people.

The Office for Budget Responsibility (OBR) forecasts indicate that 76% of the NICs increase will result in a constraint on wage growth and heightened consumer prices by 2026-27.

The OBR also projects modest household income growth, slightly exceeding past years, despite previous economic challenges such as Brexit and recent geopolitical conflicts.

Additional economic strain is highlighted due to an ageing population and escalating health service demands.

Real weekly wages are projected to see minor growth, only increasing by £13 over two decades.

The Institute for Fiscal Studies (IFS) predicts that larger firms, particularly those hiring lower-wage workers, will feel the greatest impact from higher employer NICs, potentially reducing job availability and generating less revenue than anticipated.

Paul Johnson, head of the IFS, anticipates further tax hikes and spending adjustments during the parliament's term unless economic growth improves significantly.

Opposition parties, including the Liberal Democrats, criticize the chancellor's measures as detrimental to jobs and local businesses, particularly in health and care sectors.

In defense, Prime Minister Sir Keir Starmer remarked that the government's approach is a responsible effort to stabilize the economy's foundation.