Demand For Beer And Handbags Help Temper US Recession Fears for Now

Heightened worries about the strength of consumers and the global economy have been put on hold - at least for now - after some of the world's best known companies delivered a slew of better-than expected numbers.

Unilever Plc on Thursday reported sales that topped expectations, keeping up the surprises after Nestle SA kicked off the week with a similar beat. Carlsberg A/S notched up its full-year profit outlook and LVMH reported an 18% sales surge as Chinese shoppers splashed out on luxury handbags and jewelry.

The good news wasn't confined to consumer goods. Results from Alphabet Inc.'s Google and Microsoft Corp. gave Big Tech a lift, and Europe's banks largely added to the positive mood.

The figures paint a picture of a world where households, businesses and economies are putting up resistance to the tightening vise of rampant inflation and rising interest rates, and delaying the recession some forecast will take hold this year.

But it's still a grind and cracks are showing. Crucially, the share-price reaction to recent results has been muted at best as investors worry about the outlook.

Also on Thursday, drinks maker Keurig Dr Pepper Inc. reported quarterly earnings that beat the average analyst estimate. Household and personal-care products seller Church & Dwight Co. cited strong consumer demand as it issued guidance that was above analyst estimates. Mastercard Inc. reported spending growth on its cards accelerated in the first three months of the year, topping estimates, as the payment giant continues to benefit from a rebound in travel.

"At the beginning of this year we were expecting to see a recession in several economic regions, and that hasn't actually come through," said Eleanor Taylor Jolidon, co-head of global equities at Union Bancaire Privee. And while market earnings expectations had been revised down, "there was quite a big relief to see that the first quarter has gone quite well across a number of sectors."

Meanwhile drinks firm Pernod Ricard SA forecast annual profit growth of 10% even after its quarterly sales fell short of expectations.

"Today we see pretty good resilience in Europe," said Alexandre Ricard, the chairman and chief executive. "So far, so good."

Automakers including Mercedes-Benz Group AG and Renault SA have also been faring better than expected, even amid the inflation pressure on buyers. They're benefiting from strong order books that piled up from long stretches of supply-chain problems, but the question is how long the tailwind can last.

American Consumers

The US economy took some of the shine from the news on Thursday, reporting slower-than-expected growth of 1.1% in the first quarter. Consumer spending, however, rose 3.7%, the fastest in almost two years.

"The consumer is the backbone of the US economy, and the consumer is resilient," said Lindsey Piegza, chief economist at Stifel Nicolaus & Co. in Chicago.

Amid the multiple factors pushing and pulling on demand, inflation is the key. Consumers see it in the news headlines, experience it in the supermarket stores and feel it in their pockets.

"It's very far from certain that there will be deflationary pressures in the second half of the year," said Unilever Chief Executive Alan Jope. Executives pointed to pressure from wages and food products such as sugar.

Lower Bar

There are other reasons to be cautious about the latest earnings season. The better-than-expected results can be partly explained by a sharp cut in analysts' estimates, which lowered the bar for companies to outperform. Coming out the other side, data from Bloomberg Intelligence show that while nearly 83% of S&P 500 firms beat first-quarter estimates so far - the biggest proportion since the second quarter of 2021 - the average stock has outperformed the index by just 0.2% on the day of results.

And those that missed expectations have been punished to a larger degree, underperforming the benchmark by almost 3%.

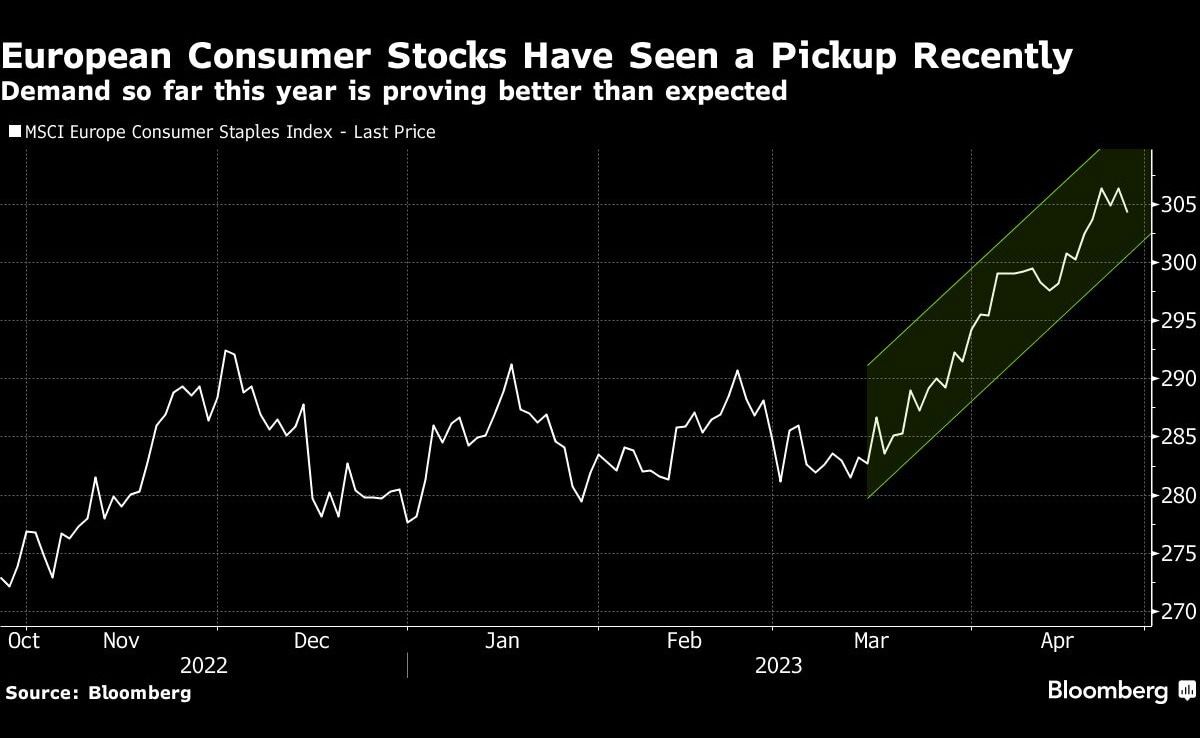

In Europe, the Stoxx 600 Index has struggled to sustain a first-quarter rally since the start of the reporting season.

"It would be naive to extrapolate the initial positive start to the earnings season as a sign of higher stock market performance as there are a number of headwinds," said Aneeka Gupta, director of macroeconomic research at WisdomTree. She noted "tighter lending standards owing to the banking crisis, further rate rises by the European Central Bank due to the stickier core inflation, currency headwinds and a global economic slowdown."

Some of the consumer strength may be thanks to the scale of savings after the pandemic. But that's not an endless resource. And it may dwindle even faster as mortgage rates rise, tightening the squeeze on borrowers. That's a particular risk in the UK, where a housing affordability crisis is brewing.

"Every household up and down the country has spent a lot of time noticing the prices of different products," Simon Roberts, chief executive of grocery chain J Sainsbury Plc said. "Customers have been watching every penny and every pound. Some of that behavior has definitely accelerated over the last few months."

A number of consumer companies see Europe as the weak spot. Unilever Chief Financial Officer Graeme Pitkethly said consumer sentiment in the region is already lower than in its other markets.

"We are also very cautious looking forward," said Nestle CFO Francois-Xavier Roger. "We see in some markets, more specifically in Europe for example, volume of consumption being in negative territories."

On the pricing front, easing commodity prices haven't yet translated fully through to shoppers because companies hadn't put through all the cost increases and were catching up to protect margins.

On Thursday, Carlsberg warned that the impact on demand from higher beer prices and faster inflation "remains uncertain."

According to Bernstein analyst Bruno Monteyne, there's a reckoning coming at some point.

"Something has to change," he said. Either volumes start dropping now, bringing inflation under control, or they remain strong, leading to even bigger price increases, which leads to a slowdown later. "How long can we keep dancing to this tune?"