How fintech and AI will not only boost businesses and make banking affordable but also help us ‘live’ forever

Financial technology (fintech) and artificial intelligence (AI) have the potential to transform everything from managing risk, to boosting financial inclusion.

Industry leaders and investors at November’s Hong Kong FinTech Week 2020 discussed how humanising fintech could not only improve the bottom line of businesses but also significantly enhance the lives of consumers.

The fully virtual event held from November 2 to 6, which attracted over 1.2 million viewers and led to more than 18,000 business contacts being made, featured over 100 hours of content, more than 350 speakers and over 500 exhibitors, and 230 journalists and 29 delegations from more than 130 economies.

Better way to identify and meet people’s needs

Martin Lau, president of Chinese tech conglomerate Tencent, who spoke at one of the event’s sessions, predicted that within 10 years, every financial business will have become a fintech company because of the power of the technology.

He highlighted three core components that fintech provides: better engagement with consumers, increased connectivity with different parties in the ecosystem, and better use of data to gain customer insights and manage risk.

Lau told FinTech Week in a video pre-recorded in October that China’s vibrant fintech sector was the result of the lack of a dominant incumbent payment system, which had led to a rapid consumer take-up of mobile payments upon which additional services were being built.

He said he expected to see a similar growth in fintech in emerging economies, particularly those that not only lack a strong incumbent payment method, but also have many people who are also unbanked.

“It creates an environment where people can embrace new financial technology more easily than in the Western world,” he said. “Some of the very vibrant fintech culture in China will be replicated in other markets, too.”

Jessica Lam, group chief strategy officer at the Hong Kong-based fintech unicorn, WeLab, who spoke at the event, predicts that virtual banking will have become the “new normal” in five years’ time, and the next generation will not know the difference between traditional and virtual banks.

She likened the adoption of virtual banking to smartphones: when they were launched, many people thought the phones were only for “techies”, yet after six years, even her parents had one. “As adoption and popularity [of virtual banking] increases, confidence will come with it,” Lam said.

The Hong Kong Monetary Authority’s virtual bank licensing regime – which uses the same regulatory framework and offers customers of traditional and virtual banks an identical HK$500,000 (US$64,505) deposit protection – has also helped to increase the confidence of Hong Kong consumers to try virtual banks.

Fintech helps to offer consumers faster, more convenient and cheaper services, including customised and relevant tech-enabled and data-driven products, Lam said.

It means people can remotely open a virtual bank account within minutes 24/7, through electronic verification such as facial recognition and ID card scanning within minutes.

“Customers have taken advantage of this, with 43 per cent of WeLab Bank customers opening accounts [outside] office hours,” she said.

Power will come from information

Dr Lee Kai-fu, chairman and CEO of Sinovation Ventures, a venture capital company, spoke at FinTech Week about how AI and big data could be used to improve businesses and boost financial inclusion.

He said the most important thing financial services companies can do is to gather as much relevant structured data as possible and connect them with AI to optimise their business outcome. This could involve reducing defaults for a loan company, detecting fraudulent transactions for a credit card provider or optimising investment returns for an asset manager.

Lee said that the increased use of AI in financial services was opening up the sector to consumers who had previously been excluded.

He said one example is MYbank – the online bank of Ant Group, an affiliate of Alibaba Group Holding, the Chinese conglomerate that owns the South China Morning Post – which uses an AI application for risk mitigation in lending decisions in China. “The empowerment is massive,” he said.

The same technology could be used to offer microloans at reasonable interest rates to people in developing countries, Lee said. Although microloans were currently offered through feature phones in Africa, for example, the rates were often predatory.

“People in developing countries need access to cash for businesses they are building,” he said. “It is exciting to watch technology support the entrepreneurial spirit in countries that are relatively poor.”

Will machines emulate humans by 2029?

Inventor and futurist Ray Kurzweil told FinTech Week about a very different application of AI, namely using it to enable humans to “live” forever. Kurzweil has spent the past 30 years focusing on how AI can be used to lengthen people’s lives.

The first three phases of this process involved using AI and other technology to overcome disease, measure and improve what was in people’s bloodstream, and to replace the body’s organs, he said.

The fourth and final phase would see people’s brains being backed up in the cloud. “In the 2030s, we will augment our brains with cloud intelligence through communicators at the top level of the neocortex,” Kurzweil said.

“By the time we get to the 2040s, we will have multiplied our intelligence a billion-fold. Our intelligence will be primarily in the cloud.”

He said enormous gains were being made by AI every month and he predicts that by the end of 2029 AI will have passed the so-called Turing test and be able to do everything a human being can do.

Kurzweil said those people who are sceptical about his predictions should remember that smartphones have already amplified what people can achieve, and connecting our brains to the cloud is simply the next step.

Digitalisation at national level

Fintech development not only creates opportunities for businesses and consumers, but it also has implications for governments.

Ray Dalio, founder, co-chairman and co-chief investment officer of the world’s largest hedge fund, Bridgewater Associates, told FinTech Week that he expects to see an increase in countries issuing a digital version of their national currency controlled by their central bank.

However, he is unsure whether cryptocurrencies will ever become mainstream. He said that currencies have two main functions: to be a medium of exchange and a store of wealth.

Yet the volatility of cryptocurrencies, the fact that central banks will not use them and governments could outlaw them serve as major impediments to the adoption of cryptocurrencies. “We are a long way from these being viable alternative currencies,” he said.

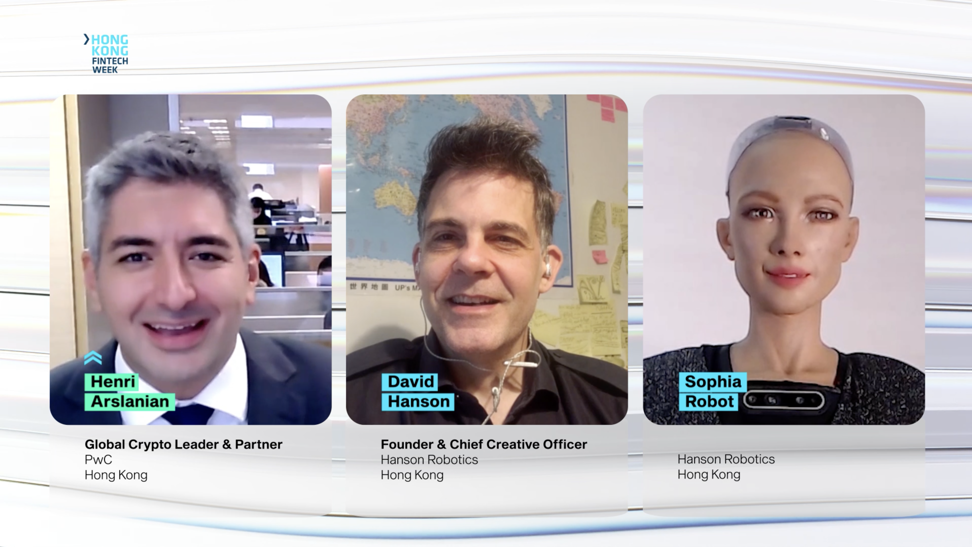

However, Henri Arslanian, global crypto leader at PwC, who spoke at FinTech Week and moderated several of its sessions, including one with UN ambassador Sophia, a humanoid robot created by Hong Kong-based Hanson Robotics, believes the development of cryptocurrencies is one of the key financial trends the public needs to watch in 2021.

“There are numerous developments taking place, not only in Asia but also globally,” he said after the event.

Arslanian predicts China will become the first G20 country to issue a central bank digital currency – creating a third form of central bank money – and he also expects rising consumer take-up of cryptocurrencies because of the increased benefits they offer.

One example is stablecoin, a cryptocurrency that minimises volatility by being pegged to a fiat currency, such as the United States dollar, he said.

Consumers can use stablecoin to make cross-border payments in US dollars to anywhere in the world, instantaneously for no fee, Arslanian said.

Cryptocurrencies are also becoming more retail-friendly and easier for consumers to buy, he said.

Online payment company PayPal, for example, recently announced that its customers in the US – who are able to buy and sell a number of cryptocurrencies, including bitcoin, litecoin and ethereum, through their PayPal digital wallet – will soon be able to use them to pay the group’s 26 million merchants worldwide.

“There is now a lot more awareness and acceptance of cryptocurrencies due to increased regulation around the world,” Arslanian said.

FinTech Week offered a fascinating glimpse into some of the ways fintech is set to change our lives in the future.

Whether AI will enable people to live forever remains to be seen, but it is clear that it is already helping to transform – and humanise – the financial services sector for the benefit of society throughout the world.