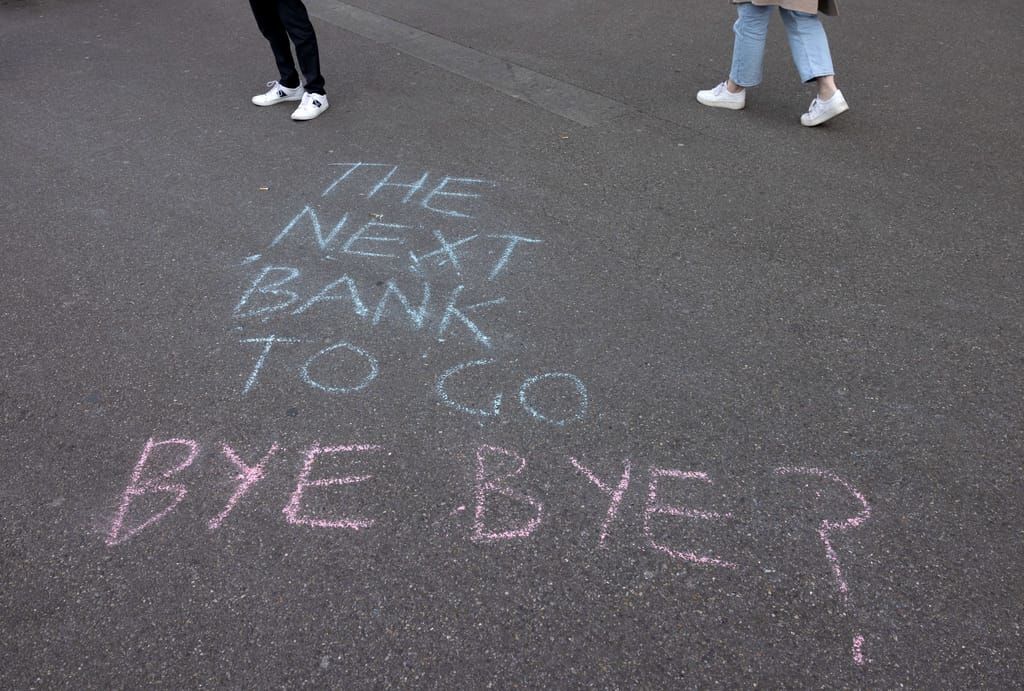

If boring Switzerland can’t save its banks, who can?

Oh, Switzerland — that beautiful land of financial stability, reliability and everything being just a little dull.

Not anymore. As Credit Suisse, Europe's 19th biggest lender, goes down the tubes, becoming the most dramatic banking casualty since the 2008 financial crisis, the worry now is it turns out to be the first domino in a chain that stretches round the world.

After all, we've been here before and it wasn't pretty.

And if boring, safe Switzerland can't save its banks, then, well, who the hell can?

To understand what happened, think of a shotgun marriage. On Sunday, the stricken Zurich-based lender was forced by Swiss authorities to get into bed with its longtime domestic rival UBS. It was historic. A 3 billion Swiss-francs deal that — for a few hours at least — allowed everyone to breathe a sigh of relief.

The aim was to protect investors and depositors and to stem a full-on banking crisis. Temporarily at least, that was achieved.

But as usual, the devil is in the detail. As the markets picked over the Credit Suisse corpse, alarm bells started to ring.

'Don't do this stuff'

The way the Swiss structured the rescue might have made things worse.

Since the crisis a decade and a half ago, regulators have tried to prevent financial institutions in distress from infecting each other with their problems by forcing losses onto bondholders (rather than depositors and ultimately the taxpayer).

But even those who held the riskiest type of bond were confident they wouldn't be affected until shareholders footed the bill first.

In the Credit Suisse case, Swiss regulators turned this normal way of doing things on its head, wiping out the bondholders first — and that has triggered financial panic across the system.

Credit Suisse was forced by Swiss authorities to get into bed with its longtime domestic rival UBS

Credit Suisse was forced by Swiss authorities to get into bed with its longtime domestic rival UBS

"A few who had lines to regulators tried to stop them doing this stuff, for exactly this reason," an expert on bank liquidity at the International Monetary Fund told POLITICO on condition of anonymity because of the sensitivity of the situation.

It's the classic example of how contagion can spread throughout the system. If investors suddenly think their bonds are riskier than before, it can lead to a sell-off, pushing prices down and undermining confidence in the whole system.

If the unexpected wiping of these bondholders leads to their broad repricing, banks could see the cost of their financing go up substantially, adding to their troubles, bank analysts at JP Morgan warned.

In a bid to calm nerves after the Swiss decision, a trio of European oversight bodies — the Single Resolution Board, the European Banking Authority and the ECB's supervisory arm — released a joint statement to reassure investors that in case of a bank collapse in the EU, shareholders would suffer first.

And the Bank of England jumped on the bandwagon. “Holders of such instruments should expect to be exposed to losses in resolution or insolvency in the order of their positions in this hierarchy,” it said.

In other words: Please don't start panicking.

Same, but different

But Credit Suisse's collapse also raises serious questions over whether the system was quite as solid as the banking police thought it was in the first place.

According to all regulatory measures, the bank was well capitalized and had plenty of assets it could cash in. That could imply that the rules introduced in the wake of the 2008 crisis aren't as tight as people believed. And if that's the case, we could be headed for real trouble.

If there's solace to be found anywhere, it is in the uniqueness of Credit Suisse's case. Its troubles began long ago and have little similarity to the issues that brought down Californian lender Silicon Valley Bank (SVB) two weeks ago.

Swiss authorities confirmed the bank was not exposed to higher interest rates the way SVB was when they moved to backstop the bank with a 50 billion Swiss franc facility last Thursday.

If there's solace to be found anywhere, it is in the uniqueness of Credit Suisse's case

If there's solace to be found anywhere, it is in the uniqueness of Credit Suisse's case

It was when that reassurance failed to subdue the panic in the bank’s share price that markets turned to the bank’s broader reputational, culture and profitability issues.

Things came to a head last week when Saudi National Bank, one of Credit Suisse's most recent investors and partly owned by the Saudi sovereign wealth fund, signaled it was not prepared to plow more capital into the group.

Spying scandal

Credit Suisse's difficulties go back even further. Under pressure to make its investment bank profitable as increased regulation clipped its wings, it recruited former insurance executive Tidjane Thiam as CEO in 2015 with a mandate to turn things around.

Thiam’s immediate response was to initiate a far-sweeping restructuring program cutting thousands of jobs, slashing costs and scaling back the investment banking division.

But the effort ran into trouble when the investment banking division struggled to keep up with its competitors and, worse still, became embroiled in a series of loss-making scandals, including a $5.5 billion loss related to the collapse of the Archegos hedge fund.

A spying scandal, in which the bank was carrying out surveillance of its own employees, forced the executive out.

Credit Suisse's board turned to Thomas Gottstein to be CEO. He promised to continue Thiam's efforts to restructure the bank, but acknowledged that more needed to be done to address deep-rooted cultural problems.

In 2021, it was rocked by its involvement with the failed finance firm Greensill Capital. The bank was once again forced to take a massive write-down and Gottstein had to quit.

A new plan was unveiled in 2022 under the helm of the bank’s most recent CEO, Ulrich Körner, which included further cuts to the investment banking division, as well as a renewed focus on wealth management and other core businesses. The bank also pledged to take steps to address its culture and risk management practices, in an effort to prevent future scandals.

But the onset of the Ukraine war and the imposition of sanctions choked its ability to service the wealth management needs of some of its wealthiest clients.

Plans to spin out the group’s investment division under a reinvigorated Credit Suisse First Boston brand operating out of New York hit a roadblock in February when it became clear the bank would struggle to find an investor to bankroll the operation on concerns about how creditors would be ranked in the event of a group-wide failure.

With no further runway left, a collapse looked like just a matter of time.