Lord Ahmad admits flaws with UK financing models for small states

Premier Fahie, who was vilified by Opposition Leader Hon Marlon A. Penn (R8) and pressured by controversial ex-Governor Augustus J.U. Jaspert to sign the loan guarantee agreement, went against hastily taking up the loan guarantee over concerns that future catastrophic disasters would immediately put the territory at risk of breaching financial protocols imposed by the UK.

Now, the UK Foreign Office Minister for the Overseas Territories, Lord Tariq Ahmad has confirmed this position long held by Premier Fahie and his Government.

UK committed to review of small state financing – Lord Ahmed

Following a July 15, 2021, virtual dialogue with Caricom leaders, including Prime Minister of Antigua and Barbuda and Chairman of Caricom, Honourable Gaston A. Browne, along with Assistant Secretary-General Mr Joseph Cox, as well as Ministers from Belize and Saint Vincent and the Grenadines, Lord Ahmad addressed the issue.

“We need to take a fresh look at finance for small states. Gross national income does not tell the whole story, especially when a natural disaster can wipe out a year’s GDP in a single day,” he said.

“It does not capture the remoteness, vulnerability, or tell us about the challenge of protecting biodiversity and responding to climate change they face. We must come together to see progress that better supports our friends in the Caribbean and their access to finance,” he went on to say.

As part of these very concerns, the Government of Premier Fahie has long been seeking to negotiate with the Government of the United Kingdom for certain terms of the Protocols for Effective Financial Management (PFEFM) to be relaxed or amended to allow Government to freely seek immediate relief funding to help in the recovery and development of the territory following the devastation caused by hurricanes Irma and Maria in 2017.

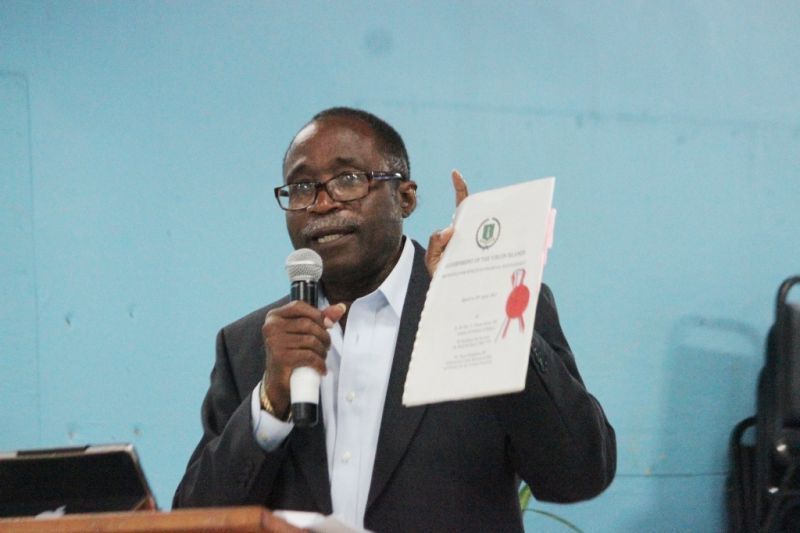

Premier Andrew A. Fahie who was vilified

by both Opposition Leader, Hon Marlon A. Penn (R8) and embattled

Ex-Governor, Augustus J.U. Jaspert resisted pressure to take up the loan

guarantee over concerns that future catastrophic distastes would

immediately put the territory at risk of breaching financial laws

imposed by the UK.

Premier Andrew A. Fahie who was vilified

by both Opposition Leader, Hon Marlon A. Penn (R8) and embattled

Ex-Governor, Augustus J.U. Jaspert resisted pressure to take up the loan

guarantee over concerns that future catastrophic distastes would

immediately put the territory at risk of breaching financial laws

imposed by the UK.

Review Protocols for Effective Financial Management - Premier

One of the terms the VI is seeking relief from is the controversial borrowing ratios imposed on the Territory by the UK in the PFEFM signed into agreement in 2012 by the previous National Democratic Party (NDP) Government.

Premier Fahie, during a COVID-19 update on April 15, 2020, said Cabinet had agreed to instruct the Financial Secretary to lead technical discussions with the UK Government’s financial technical team in petitioning the Secretary of State to relieve the Government of the Virgin Islands of its obligations under Section 20 of the Protocols for Effective Financial Management and the review and amendment of Sections 25, 27 and 28.

According to Hon Fahie, a review of the protocols would “enable the BVI Government to secure the funding necessary to respond to catastrophic events such as the COVID-19 pandemic, in light of 1. The real impacts and economic forecast outlook for the BVI due to the catastrophic COVID-19 pandemic, 2. The unavailability of grant funding from the UK Government and 3. The impediment the conditions of the Protocols for Effective Financial Management pose to the BVI Government being able to finance immediate relief and economic stimulation programmes on its own.”

As the COVID-19 pandemic raged on,

Premier Fahie in his refusal to sign the guarantee had faced more

backlash and criticisms from Opposition Leader Hon Marlon A. Penn as

recent as February 2021 to take up loan guarantee with an accusation of

him ‘having no plan’.

As the COVID-19 pandemic raged on,

Premier Fahie in his refusal to sign the guarantee had faced more

backlash and criticisms from Opposition Leader Hon Marlon A. Penn as

recent as February 2021 to take up loan guarantee with an accusation of

him ‘having no plan’.

UK financial control should VI violate ratios

Under the current financial ratios, the territory is required to maintain under the Protocols: net debt of 80 per cent maximum or recurrent revenue; debt service of 10 per cent maximum of recurrent revenue; and liquid assets of 25 per cent of recurrent expenditure.

If the VI government violates those limits, it would be required to submit to greater fiscal controls under the UK.

Section 28 of the PFEFM, which is one of the sections the VI Government is seeking an amendment to, particularly states that a breach of the borrowing limits will constitute a breach of the Agreement.

The VI Government has also been trying to get the UK to revise the borrowing ratio for the VI to access adequate funding for hurricane recovery so that it does not violate the Protocols for Effective Financial Management.

Senior Opposition Legislator Hon Julian

Fraser RA, speaking at a public meeting at St Mary’s Church Hall on

Virgin Gorda, on March 7, 2018, said that should the VI take the loan

with the current conditions, the territory could become the victim of

countries and institutions whose agenda is to enrich themselves while

making other countries heavily indebted and ultimately getting the upper

hand over those countries’ government and economy.

Senior Opposition Legislator Hon Julian

Fraser RA, speaking at a public meeting at St Mary’s Church Hall on

Virgin Gorda, on March 7, 2018, said that should the VI take the loan

with the current conditions, the territory could become the victim of

countries and institutions whose agenda is to enrich themselves while

making other countries heavily indebted and ultimately getting the upper

hand over those countries’ government and economy.

VI Opposition Leader continued backlash

As the COVID-19 pandemic raged on, Premier Fahie in his refusal to sign the guarantee had faced more backlash and criticisms from Opposition Leader Hon Penn as recent as February 2021 to take up loan guarantee with an accusation of Premier Fahie ‘having no plan’.

Senior Opposition Legislator Hon Julian Fraser RA, speaking at a public meeting at St Mary’s Church Hall on Virgin Gorda, on March 7, 2018, said that should the VI take the loan with the current conditions, the territory could become the victim of countries and institutions whose agenda is to enrich themselves while making other countries heavily indebted and ultimately getting the upper hand over those countries’ government and economy.

With the Fahie government refusing to sign the loan guarantee offered by the UK as is, despite pressure from ex-governor Jaspert, there is suspicion that the Commission of Inquiry is a last-ditch effort to allow the UK to gain control of the Virgin Islands' finances and resources.