What is Jack Ma’s Ant Group and how does it make money?

Digital financial services giant Ant Group is on the cusp of pulling off the world’s biggest initial public offering and could be worth over US$500 billion in the near future, riding on the digitisation of financial services in the world’s second-largest economy.

Hangzhou-headquartered Ant’s coming out parade illustrates China’s lead in digital finance. Its super-slick mobile payment app, Alipay, has over 1 billion users, making it the world’s most popular app outside social-media networks.

Ant’s payments network is just the gateway, funnelling small businesses and consumers into a broad financial ecosystem spanning lending, investment and insurance services.

The world’s most valuable privately owned company is also developing services to make daily life easier. Consumers can click on the Alipay app for services ranging from food deliveries to garbage collection.

The system’s cogs are oiled by a trove of data gathered in China, the world’s most populous country, which makes pricing more accurate and efficient than at traditional banks.

Ant plans to plough the US$34.5 billion it is raising from dual listings in Hong Kong and Shanghai into future revenue drivers, such as blockchain, growth outside China and merchant services.

In this explainer, we take a look at the growth potential of Ant’s key businesses and why the company could soon be worth more than the world’s largest bank, JPMorgan Chase.

“We believe that if we can enable ordinary people to enjoy the same financial services as the bank CEO and help mom and pop shops to obtain growth financing as easily as big firms, then we will be a company that belongs to the future,” Eric Jing, Ant’s executive chairman, said in the company’s prospectus.

What is Ant?

Ant traces its origins back to 2004, when Chinese e-commerce giant Alibaba Group Holding created Alipay to bridge a lack of trust between buyers and sellers in the early days of online shopping in mainland China.

In 2011, Alibaba, the owner of the Post, spun off Alipay, so that it could apply for a payment business licence in mainland China. That company, then known as Zhejiang Alibaba E-Commerce Company, changed its name to Ant Financial and eventually morphed into Ant Group.

Ant reported revenue of 118.19 billion yuan (US$17.7 billion) in the nine months ended September, a 43 per cent increase over the same period in 2019.

It dwarfs Palo Alto-based PayPal’s user base of PayPal, which had 346 million active accounts as of June 30 and is the largest digital payments platform outside China. PayPal generated revenue of US$12.8 billion in the first nine months of 2019 and US$9.88 billion in the first half of this year.

Ant sees further room for growth as China’s digital payments transaction volume is expected to increase to 412 trillion yuan by 2025, from 201 trillion yuan last year, according to consultancy iResearch. The compound annual growth rate in Ant’s annual active users was 15 per cent between 2017 and 2019.

What are Ant’s key businesses?

Ant is cross-selling and upselling higher-value financial products to users of its payments network and sees engagement with its customers growing tenfold in the coming five years.

Ant acts as a lending, investment and insurance products platform for individuals and underserved small businesses. Its revenue per user is just 121 yuan, still small compared with traditional financial institutions.

Digital financial services contributed more than half of Ant’s overall revenues in the six months ended June 30.

Its largest business is now what it has dubbed CreditTech, providing credit to consumers and small businesses, surpassing payments and generating 39.4 per cent of its revenue in the six months ended June 30.

Ant is the largest online provider of microfinance services in China in terms of total outstanding credit balance originated through its platform, according to consultancy Oliver Wyman.

Management likens China’s banks to the arteries of the economy, financing growth. They see Ant as the capillaries that transmit funds to the extremities of the economy, small businesses and individuals.

Ant originates loans, 98 per cent of which are then underwritten by financial institutions or securitised. As of June 30, it was working with about 100 banks, including all policy banks, large national state-owned banks, all national joint-stock banks, leading city and rural commercial banks, international banks that operate in China, as well as trust companies.

Its platform takes just three minutes to process a loan and 1 second to disburse the loan, with zero human intervention.

The consumer credit and small business credit balance in China could swell to 50 trillion yuan by 2025, and Ant has only tapped about 4 per cent of this huge market so far.

In investment services, Ant has partnered with 170 asset managers, as well as banks and insurers, to provide wealth management products to its customers. As of June 30, the so-called InvestmentTech segment had 4.1 trillion yuan in assets under management sold through Ant’s platform.

The insurance business also is a growing segment, accounting for 8.4 per cent of its revenue in the six months ended June 30.

Ant is the largest online insurance services platform in China in terms of premiums generated, according to Oliver Wyman. It has relationships with about 90 insurers in the mainland, representing about 52 billion yuan in premiums generated and contributions through its online mutual-aid platform Xiang Hu Bao in the twelve months ended June 30.

China’s online insurance premiums will hit 1.9 trillion yuan by 2025 at a CAGR of 38.1 per cent, said Oliver Wyman. Ant’s premiums are still under 1 per cent of this fast-growing pie.

How does Ant compare with Tencent Holdings?

Alipay and Tencent’s WeChat Pay command a virtual duopoly in China’s mobile payments, which accounted for US$15.9 trillion in transactions in the second quarter, according to the most recent data from the People’s Bank of China.

There were 30.1 billion mobile transactions alone in the mainland in the second quarter, a 26.9 per cent increase over the year-earlier period.

The two players had an aggregate market share of 90 per cent of third-party mobile payments in China at the end of last year, according to Mizuho Securities.

It is difficult to directly compare Alipay to Tencent’s WeChat Pay as Hong Kong-listed Tencent does not break them out separately but WeChat Pay is included in its fintech and business services division.

In 2019, Alipay generated a higher average transaction size – 483 yuan versus 183 yuan at Tencent’s payment affiliate Caifutong, according to Morningstar analysts. Ant also generated a gross margin nearly double that of Tencent’s fintech business last year.

Other differences also remain between their payments businesses. Not least, WeChat Pay is integrated into WeChat while Alipay is a stand-alone app, linked to consumers’ bank accounts.

What are Ant’s emerging growth drivers?

Future revenue drivers include Ant’s blockchain business, dubbed Antchain, as well as international expansion and merchant services.

Ant started to explore blockchain’s potential around six years ago and has been investing in the technology ever since. It has taken the lead globally in terms of technical capability and developed around 50 commercial applications.

In March, Simon Hu, Ant’s chief executive, released a three-year plan to open up Alipay as an online gateway for businesses ranging from retailers to hotels, working with 50,000 independent software vendors to digitally upgrade 40 million merchants.

Ant’s management predicts that the 80 million small businesses it serves today will swell to 163 million by 2025.

Analysts sent research to investors on Wednesday pegging Ant’s near-term valuation roughly between US$350 billion and US$450 billion on a like-for-like basis, including the money it is raising in the IPO, according to people familiar with the matter.

On a different time frame, JPMorgan analysts are particularly bullish on future growth potential and estimated Ant’s market capitalisation would swell to north of US$500 billion post-money.

Credit Suisse analysts peg Ant’s valuation between US$380 billion and US$461 billion, with a price/earnings to growth ratio between 1.2 times and 1.4 times. They forecast Ant’s net profit will hit 56 billion yuan (US$8.4 billion) in 2021 and 75 billion yuan in 2022.

How big is Ant outside mainland China?

Mainland China accounted for 95.6 per cent of Ant’s revenue for the six months ended June 30, and most of its revenue from outside China was from cross-border payment services.

But, Ant and other payment providers are seeking to expand internationally and diversify domestically as the third-party mobile payment industry has become saturated in China in terms of the number of users.

“Future opportunities would lie in cross-border payment, inbound tourism and overseas markets,” said Ben Huang, an analyst at Mizuho Securities.

Ant has been expanding overseas for the past decade and is now present across the Asia-Pacific region and in Chinese tourist hotspots globally.

It had forged partnerships with local partners in Bangladesh, Hong Kong, India, Indonesia, Korea, Malaysia, Pakistan, the Philippines and Thailand as of March 31.

Ant also won a virtual bank license in Hong Kong and is applying for one in Singapore.

Alipay’s in-store payment service is in more than 50 markets globally. Alipay supports 27 currencies and works with over 250 overseas financial institutions and payment solution providers to enable cross-border payments for Chinese travelling overseas, and overseas customers who purchase products from Chinese e-commerce sites.

Do rising US-China tensions present a risk to Ant’s business?

Ant’s business in the US is “negligible”, but the company warned the worsening relationship between the world’s biggest economies had raised concerns the US may impose “increased regulatory challenges or enhanced restrictions” on Chinese companies.

Two years ago, Ant’s US$1.2 billion deal to acquire money transfer firm Moneygram International fell apart after a US government panel rejected the transaction over national security concerns.

Bloomberg reported this month that the US was considering potential actions against Tencent and Ant over their payment apps. Reuters also reported the US State Department submitted a proposal to blacklist Ant by adding it to the so-called entity list, which restricts the sale of certain technology.

Citing potential risks to its outlook, Ant said that restricted items compromise an “immaterial” portion of its technology and software, but any such restrictions could “materially and adversely” affect its ability to acquire technologies that may be critical to its business and impede its ability to access US-based cloud services or operate in the US.

“In addition, these policies and measures directed at China and Chinese companies could have the effect of discouraging US persons and organizations to work for, provide services to or cooperate with Chinese companies, which could hinder our ability to hire or retain qualified personnel and find suitable partners for our business,” Ant said in its prospectus.

What is the relationship between Alibaba and Ant today?

Alibaba, which owns the Post, and Ant remain closely intertwined despite Alipay being spun off in 2011, a huge competitive advantage for the digital financial services group.

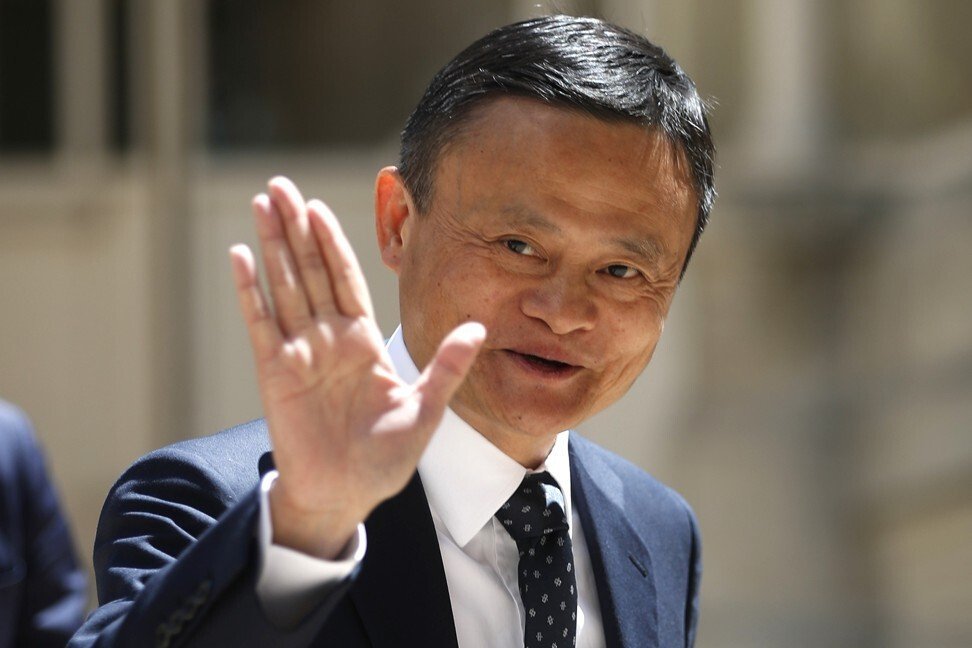

Billionaire Jack Ma holds a controlling shareholder of Ant and the co-founder and former executive chairman of Alibaba. Ma controls 50.52 per cent of Ant’s shares.

Within Alibaba’s so-called walled garden, about 70 per cent of the gross merchandise volume generated by its marketplaces in China was settled through Alipay in the twelve months to March 31.

Alibaba also pays Alipay a fee, on favourable terms to Alibaba, for payment services to its consumers and merchants. In the financial year 2020, those service fees were 8.7 billion yuan.

In February 2018, Alibaba, through its subsidiaries, took a 33 per cent equity stake in Ant, which it still holds. Alibaba has subscribed to Ant shares to prevent the IPO from diluting its stake.