UK First-Time Buyers in Strongest Position for a Decade as Affordability Improves

Data from Halifax shows mortgage costs and income ratios now most favourable since 2015 despite record-high house prices

First-time homebuyers in the United Kingdom are currently in their strongest position in a decade, according to new figures released by leading mortgage lender Halifax.

Despite the national average property price reaching a record high of £299,892 in November 2025, Halifax reports that relative affordability — measured by property prices compared to average household incomes — is now at its best since late 2015. Simultaneously, mortgage costs as a share of income have dropped to a three-year low, helped by an average two-year fixed mortgage rate of 4.85 percent.

House price growth has slowed: November saw no month-on-month increase, and annual house price growth dipped to just 0.7 percent, down from 1.9 percent in October.

While prices remain high, the stalling growth offers breathing room for buyers.

The improvement in affordability correlates with broader easing in mortgage criteria and reduced borrowing costs — a shift driven by lenders’ desire to support a stronger first-time buyer market.

As a result, many prospective buyers are seeing real opportunities to enter the housing market at more manageable cost levels than at any point since 2015.

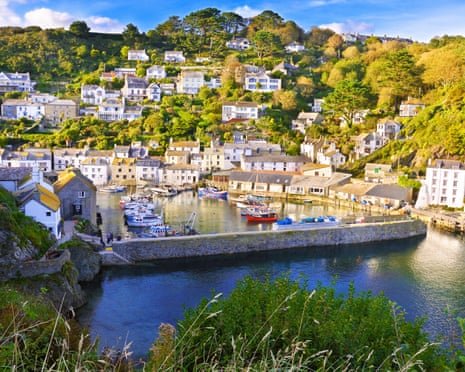

Regional variations persist: in London and the South East, high prices continue to challenge affordability, while several regions in the north and across Scotland offer more accessible entry points.

Experts suggest that with stable borrowing conditions and potential further interest-rate cuts on the horizon, the market may remain favourable for first-time buyers well into 2026.

At the same time, some analysts caution that headline affordability metrics — such as price-to-income ratios — obscure underlying pressures, including uneven income distribution, persistent high local rents, and differences in regional economic conditions that continue to limit access for many aspiring homeowners.

Nevertheless, for now and for many, the stars seem aligned: borrowing costs are lower, incomes appear more adequate relative to prices, and the market conditions may make 2025–26 a very rare window of opportunity for first-time buyers in the UK.

How long that window remains open may depend heavily on regional dynamics, interest-rate policy, and how quickly housing supply can respond to renewed demand.

Despite the national average property price reaching a record high of £299,892 in November 2025, Halifax reports that relative affordability — measured by property prices compared to average household incomes — is now at its best since late 2015. Simultaneously, mortgage costs as a share of income have dropped to a three-year low, helped by an average two-year fixed mortgage rate of 4.85 percent.

House price growth has slowed: November saw no month-on-month increase, and annual house price growth dipped to just 0.7 percent, down from 1.9 percent in October.

While prices remain high, the stalling growth offers breathing room for buyers.

The improvement in affordability correlates with broader easing in mortgage criteria and reduced borrowing costs — a shift driven by lenders’ desire to support a stronger first-time buyer market.

As a result, many prospective buyers are seeing real opportunities to enter the housing market at more manageable cost levels than at any point since 2015.

Regional variations persist: in London and the South East, high prices continue to challenge affordability, while several regions in the north and across Scotland offer more accessible entry points.

Experts suggest that with stable borrowing conditions and potential further interest-rate cuts on the horizon, the market may remain favourable for first-time buyers well into 2026.

At the same time, some analysts caution that headline affordability metrics — such as price-to-income ratios — obscure underlying pressures, including uneven income distribution, persistent high local rents, and differences in regional economic conditions that continue to limit access for many aspiring homeowners.

Nevertheless, for now and for many, the stars seem aligned: borrowing costs are lower, incomes appear more adequate relative to prices, and the market conditions may make 2025–26 a very rare window of opportunity for first-time buyers in the UK.

How long that window remains open may depend heavily on regional dynamics, interest-rate policy, and how quickly housing supply can respond to renewed demand.