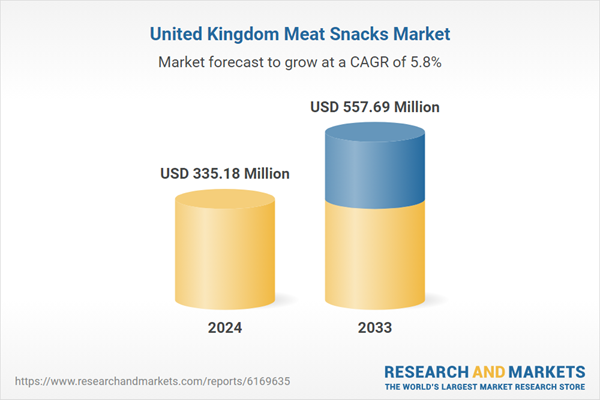

UK Meat Snacks Market Set for Sustained Growth as Premiumisation and Protein Demand Rise

Industry forecasts point to expanding revenue opportunities through twenty thirty-three amid innovation, brand competition and shifting consumer preferences

The United Kingdom’s meat snacks market is projected to record steady growth from twenty twenty-five through twenty thirty-three, driven by rising demand for high-protein convenience foods, premium product positioning and continued innovation by global and domestic brands.

Industry analysis indicates that changing lifestyles, increased snacking frequency and consumer interest in functional nutrition are reshaping the category, creating new revenue opportunities across retail and foodservice channels.

Jerky, biltong and meat sticks remain the dominant product segments, benefiting from perceptions of natural ingredients, low carbohydrate content and sustained energy release.

Premium and artisanal offerings are gaining traction as consumers show greater willingness to pay for higher-quality cuts, cleaner labels and distinctive flavours.

At the same time, value-focused products continue to appeal to cost-conscious shoppers, supporting volume growth across supermarkets, convenience stores and online platforms.

Competition in the UK market is intensifying as multinational food companies and specialist snack producers expand their portfolios.

Established global players, including Nestlé, Hormel Foods, Conagra Brands, Bridgford Foods and Hershey, are leveraging scale, brand recognition and distribution networks to strengthen market presence, while smaller and emerging brands are differentiating through British sourcing, traditional curing methods and innovative seasoning profiles.

Private-label offerings are also expanding, adding pricing pressure while broadening consumer choice.

Product development is increasingly focused on health-oriented attributes such as reduced sodium, natural preservatives and transparent ingredient sourcing.

Brands are also responding to sustainability considerations by improving packaging, enhancing supply-chain traceability and communicating animal welfare standards more clearly.

These factors are becoming more influential in purchasing decisions, particularly among younger consumers.

Looking ahead, analysts expect the UK meat snacks sector to benefit from population growth, evolving eating habits and ongoing premiumisation, while competition is likely to intensify as brands invest in marketing, innovation and distribution.

The balance between indulgence, nutrition and value is set to define competitive advantage as the market develops through the next decade.

Industry analysis indicates that changing lifestyles, increased snacking frequency and consumer interest in functional nutrition are reshaping the category, creating new revenue opportunities across retail and foodservice channels.

Jerky, biltong and meat sticks remain the dominant product segments, benefiting from perceptions of natural ingredients, low carbohydrate content and sustained energy release.

Premium and artisanal offerings are gaining traction as consumers show greater willingness to pay for higher-quality cuts, cleaner labels and distinctive flavours.

At the same time, value-focused products continue to appeal to cost-conscious shoppers, supporting volume growth across supermarkets, convenience stores and online platforms.

Competition in the UK market is intensifying as multinational food companies and specialist snack producers expand their portfolios.

Established global players, including Nestlé, Hormel Foods, Conagra Brands, Bridgford Foods and Hershey, are leveraging scale, brand recognition and distribution networks to strengthen market presence, while smaller and emerging brands are differentiating through British sourcing, traditional curing methods and innovative seasoning profiles.

Private-label offerings are also expanding, adding pricing pressure while broadening consumer choice.

Product development is increasingly focused on health-oriented attributes such as reduced sodium, natural preservatives and transparent ingredient sourcing.

Brands are also responding to sustainability considerations by improving packaging, enhancing supply-chain traceability and communicating animal welfare standards more clearly.

These factors are becoming more influential in purchasing decisions, particularly among younger consumers.

Looking ahead, analysts expect the UK meat snacks sector to benefit from population growth, evolving eating habits and ongoing premiumisation, while competition is likely to intensify as brands invest in marketing, innovation and distribution.

The balance between indulgence, nutrition and value is set to define competitive advantage as the market develops through the next decade.