Electric Vehicles = 10% of New Vehicle Sales Globally!

Global plugin vehicle registrations were up 61% in July 2022 compared to July 2021, reaching 778,000 units. This is the best result ever for a first month of a quarter. So, expect not only that Q3 will be the best quarter ever for plugins, but also that September will provide the mother of all records! I expect September will be the first time the world reaches one million plugin vehicle registrations in a month. With China (surely), Europe (likely), and the USA (maybe?) posting record months in September, expect the end of Q3 to be another time of celebration.

With a strong month in July, plugins represented 14% share of the overall auto market. Full electrics (BEVs) themselves reached 10% share of the market! Considering the steep drops in the overall market, and the fact that plugless hybrids (HEVs) were down for the fourth month in a row, that should be considered an amazing result. (And it seems peak HEV is really upon us in 2022.)

In July, BEVs (+73% YoY) grew faster than plugin hybrids (+36%), but if we exclude China from the plugin hybrid vehicle (PHEV) tally, we discover that PHEVs would be down 20% YoY. July would have been the fifth consecutive month of sales drops for the powertrain. So, excluding China, where PHEVs have evolved to 30–40s kWh battery systems (working more as EREVs than classic PHEVs), we might also be passing the peak year for PHEVs. In fact, while HEVs are dropping between 1 to 5% YoY in recent months, in the last couple of months, PHEVs have dropped by two digits YoY — so we soon might see plugin hybrids losing sales more precipitously than plugless hybrids!

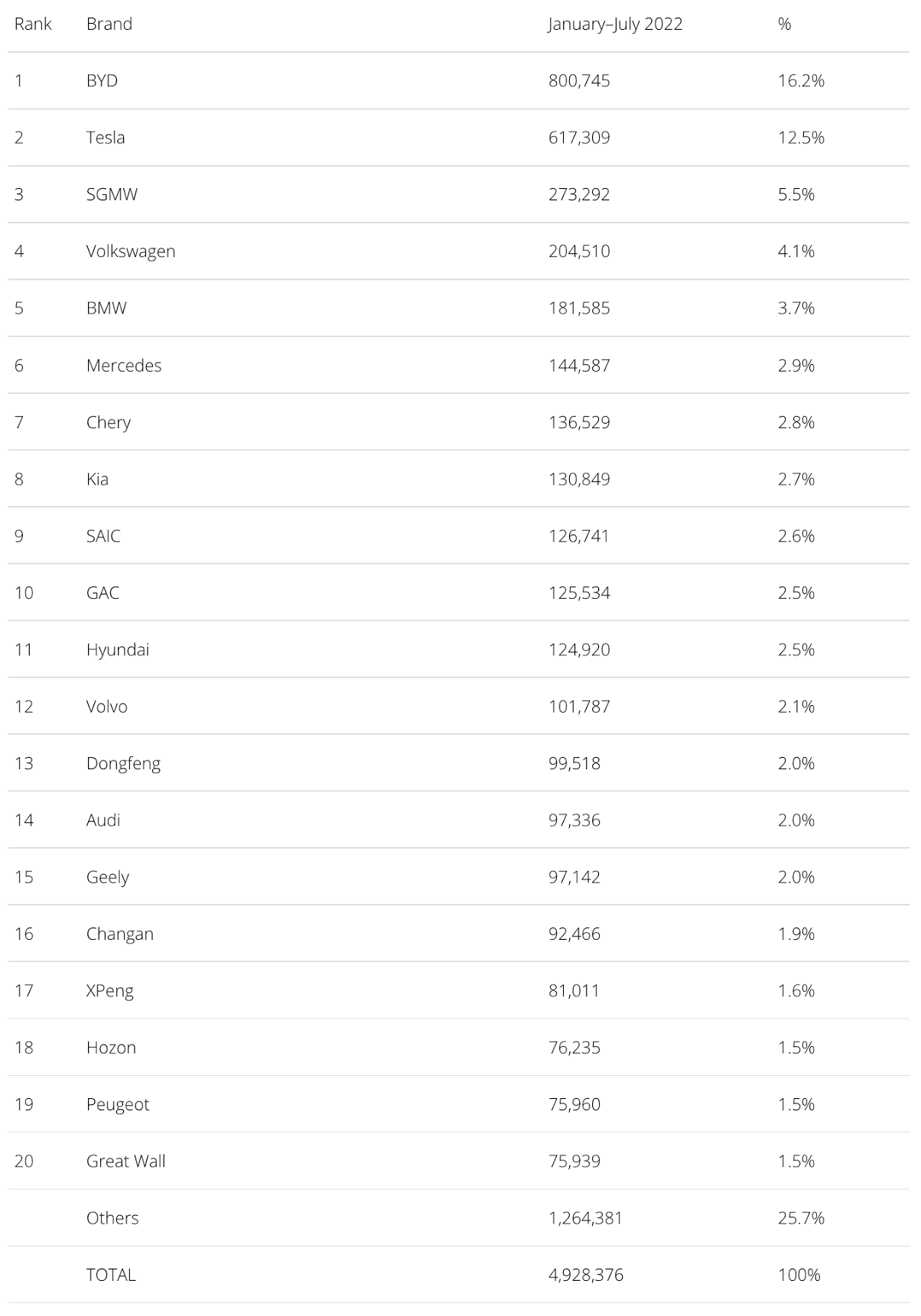

Year to date, the plugin share remained at 12% (8.9% BEV). That’s all great, but the internet loves lists, so here you go: The top 20 electric car sales leaders!

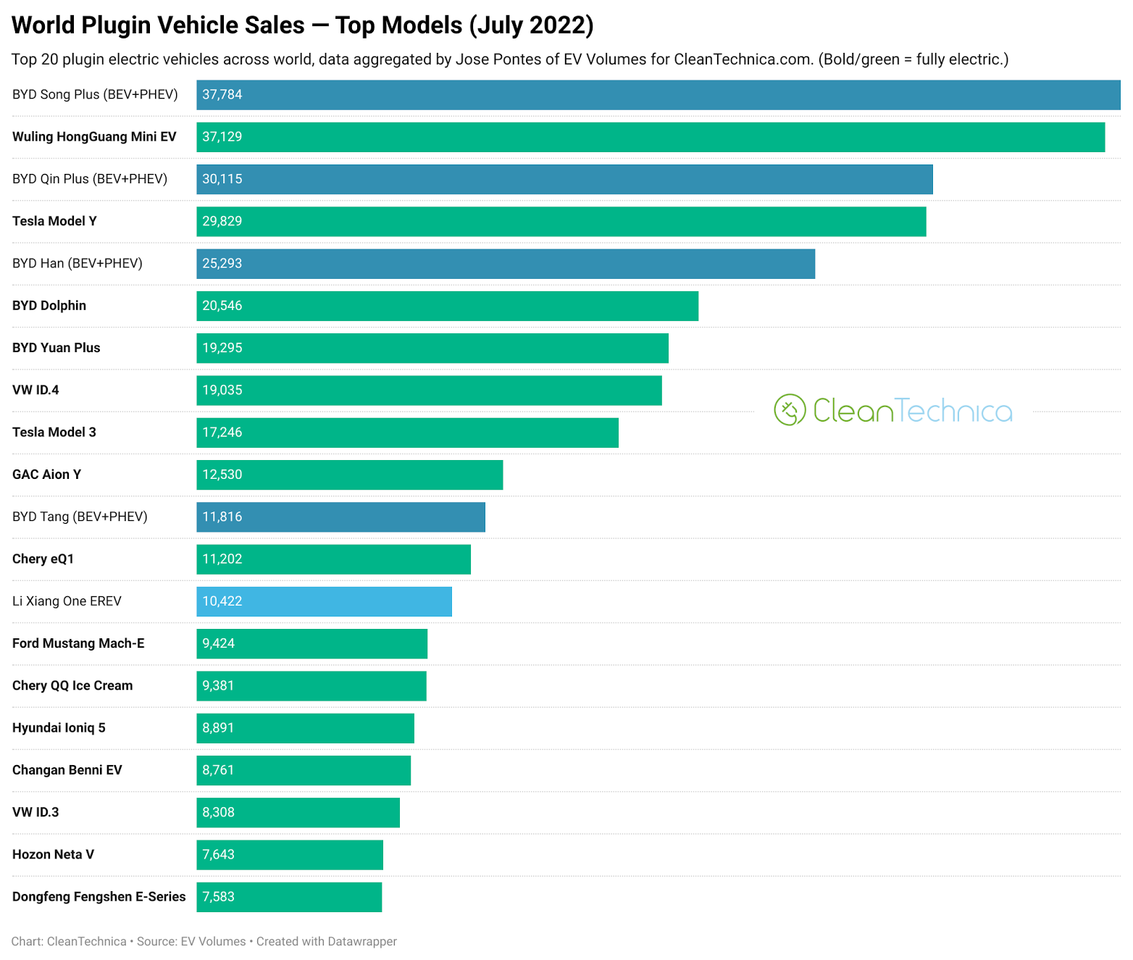

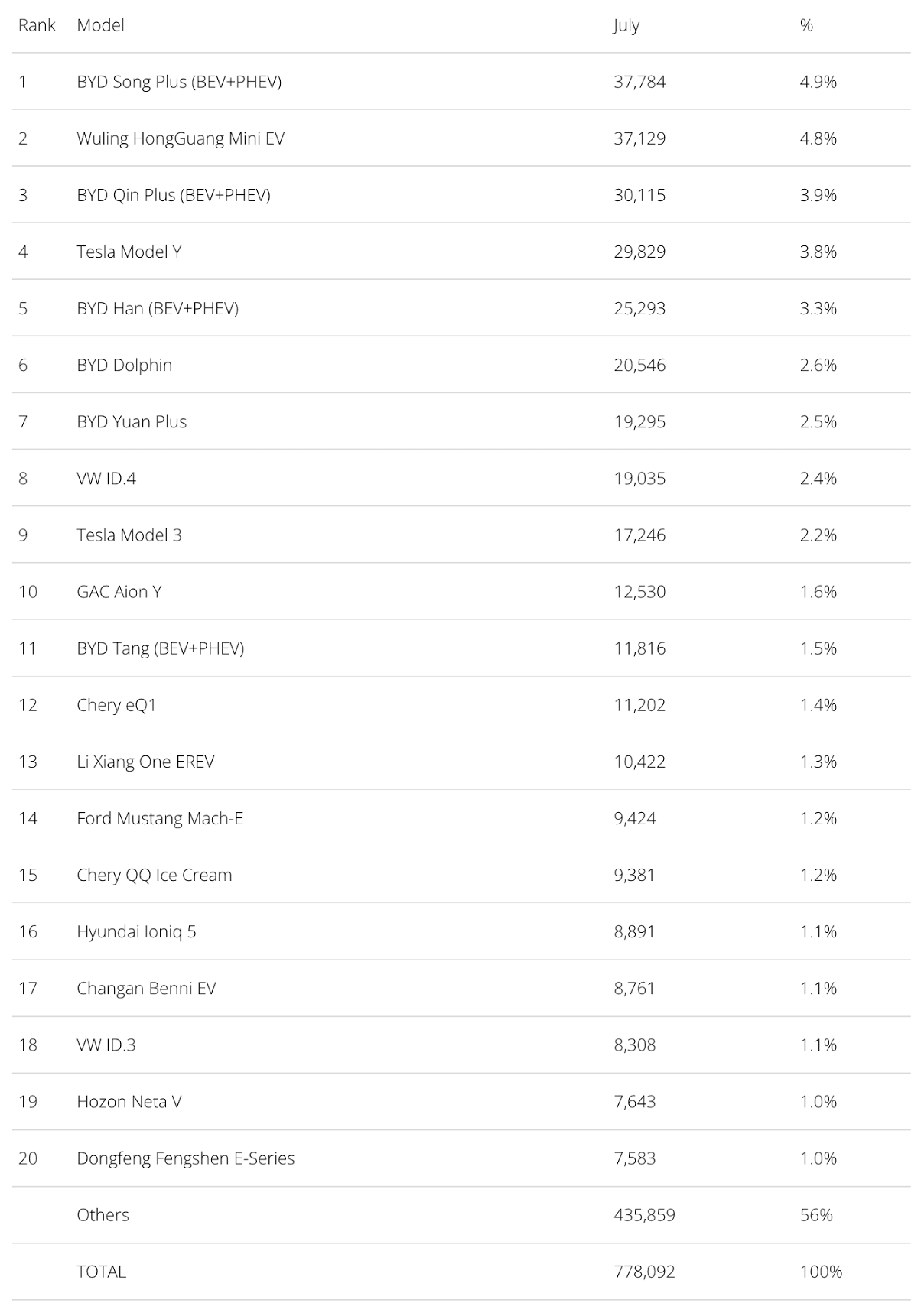

Top Selling Plugin Vehicle Models in July

Looking at the monthly best seller table, the BYD Song won its first global Best Seller trophy, thanks in good part to the PHEV version scoring a record 32,367 registrations. The Song also benefited from a slower than usual month from the little Wuling Mini EV (in 2nd place with 37,129 registrations), as well as the usual slow first month of the quarter from Tesla (particularly regarding the Tesla Model Y). The Model Y actually had its best first month of the quarter ever, though, so expect it to reach a record month in September. Will we see it reach 100,000 registrations next month?

Looking at the monthly best seller table, the BYD Song won its first global Best Seller trophy, thanks in good part to the PHEV version scoring a record 32,367 registrations. The Song also benefited from a slower than usual month from the little Wuling Mini EV (in 2nd place with 37,129 registrations), as well as the usual slow first month of the quarter from Tesla (particularly regarding the Tesla Model Y). The Model Y actually had its best first month of the quarter ever, though, so expect it to reach a record month in September. Will we see it reach 100,000 registrations next month?

In the last place on the podium, we have the BYD Qin Plus, with over 30,000 registrations. Both versions scored record sales in July (18,838 units for the PHEV version, 11,277 units for the BEV version). So, it seems the midsize sedan is still immune to the internal competition (Destroyer 05 on the PHEV side and Seal on the BEV side).

Off the podium, we have the BYD armada, with three models from the Shenzhen automaker showing up from 5th to 7th. The #5 Han (BEV + PHEV) had over 25,000 registrations (in no small part thanks to a record 15,543 registrations of the PHEV version). The #6 Dolphin also scored a new record, 20,546 registrations. And the #7 Yuan Plus ended the month with yet another record score, this time 19,295 registrations — its 6th record month in a row!

Add in the #11 BYD Tang (BEV+PHEV = 11,816 registrations) and the #21 BYD Destroyer 05 PHEV (7,404 registrations) and we have 7 BYDs in the global top 21! A third of the the 21 best selling plugins in the world are BYDs! 😮

There were other record performers in the table as well. The #8 VW ID.4 scored its second record month in a row, with 19,035 sales, thanks to a strong performance in Europe and record numbers in China. The German crossover is just waiting for the US production to ramp up to higher volumes to consolidate its position as the best selling model coming from a legacy OEM.

#10 GAC Aion Y scored a record 12,530 registrations, its second record score in a row, proving that there is a market for MPVs! This is also the highlight of yet another positive month for GAC, which also saw its Aion V crossover scoring a record result — in this case, 5,028 registrations.

The Surprise of the Month was the Ford Mustang Mach-E reaching #14 thanks to a record 9,424 registrations, and if the recent Chinese operations of the sporty crossover start to produce a significant output, we could see the ´Stang reach five-digit scores regularly.

Two other surprise appearances were: 1) the VW ID.3 showing up in #18, thanks to 8,308 registrations (with the hatchback benefitting from the production ramp up in Europe and in China — finally!), and 2) Dongfeng’s Fengshen E-Series reaching #20, thanks to a record 7,583 registrations (its second record month in a row, highlighting a new trend…).

The Hot Chinese Competition

Chinese legacy OEMs, feeling the heat from local startups, are now going full speed ahead towards EVs.

And the most significant sign of this new trend is that the daddy of Chinese automakers, the almighty Geely, is now pushing forward with all guns blazing and an eye clearly on BYD, its most direct threat. Outside the top 20, we had three Geely models scoring record results. The Geometry A (aka BYD Qin Plus/Seal fighter) reached 5,286 units. The Geometry E (aka BYD Dolphin/Yuan Plus fighter) had 5,171 units. The Emgrand L Hi-X PHEV (aka Qin Plus/Destroyer 05 fighter) registered 5,586 units. And Geely’s luxury arm, Zeekr, saw its 001 fastback model (aka BYD Han fighter) score a record 5,022 registrations.

On the Chinese new blood side of things, there are two startups shining, and neither of them is among the best known brands. Hozon’s Neta U crossover scored a record 5,070 registrations, while Hozon continued to produce decent volumes of the smaller Neta V as well, delivering 7,643 units last month and allowing it to end the month in #19. Another little known Chinese startup with huge potential, Leap Motor, saw its “Model Y fighter” C11 model reach a record 6,582 registrations. It even surpassed what had been up until now the brand’s bread and butter model, the little T03 (5,462 units). With both brands soon launching their first sedans (C01 in the case of Leap Motor and Neta S in the case of Hozon), expect these startups to continue growing significantly throughout the year.

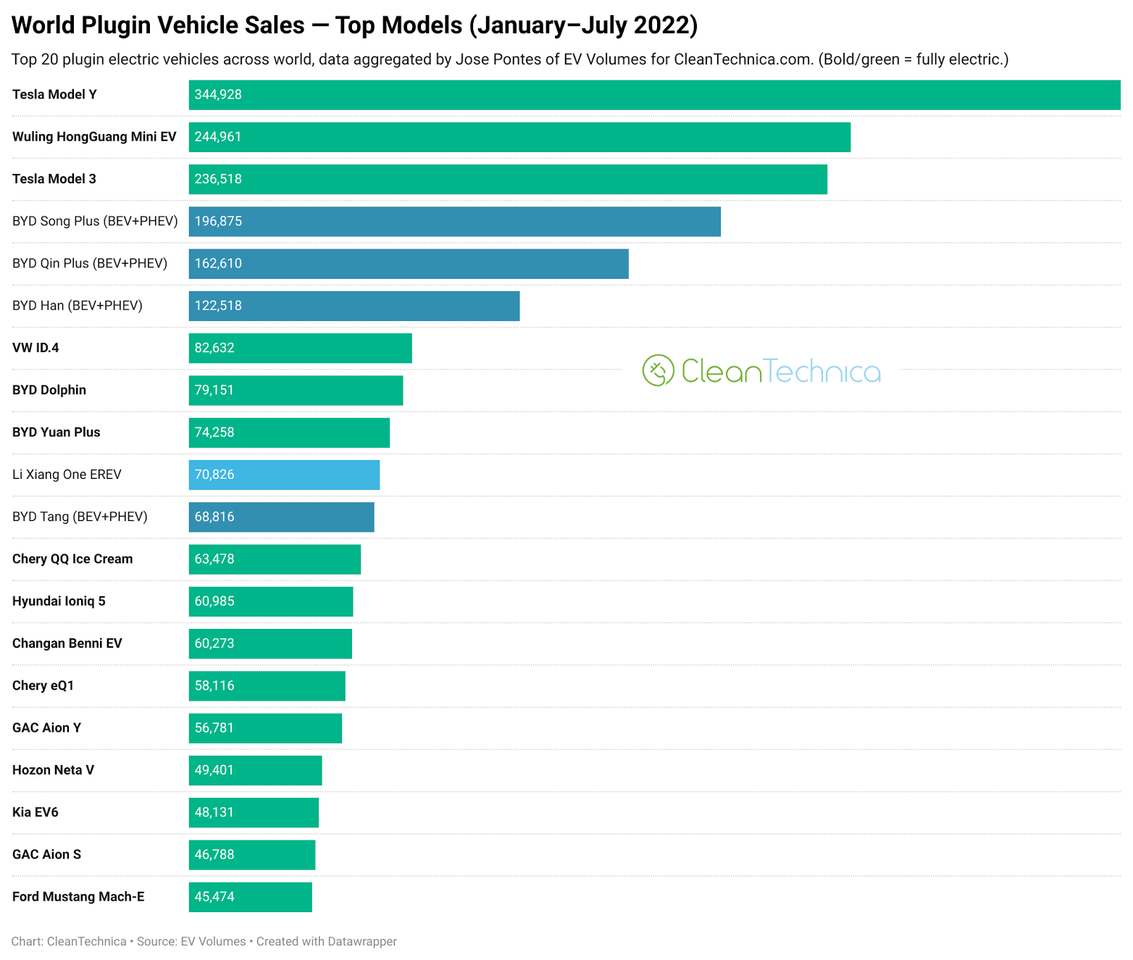

January–July Top Selling Models

In the year-to-date (YTD) table, the big news is the little Wuling Mini EV displacing the Tesla Model 3 from the runner-up position, temporarily ending Tesla’s #1 plus #2 lead on the model table. Expect the Model 3 to eventually recover in September, but the sign to the market is given: the Model 3 is no longer unbeatable.

The first change came at #8 — the BYD Dolphin was up one spot. In the position immediately below, we now see the BYD Yuan Plus, having jumped three spots to break into the top 10 and reach #9.

Next stop for both: the Volkswagen ID.4’s 7th place? Still the only legacy OEM model in the first 12 positions, the Volkswagen ID.4’s best hopes are to remain in the first half of the table and consolidate its status as the best selling model from a legacy OEM. With the #6 BYD Han some 40,000 units ahead, the German crossover is far from reaching the sales levels needed to join the A League, which is currently led by the Wuling Mini EV (the #1 Tesla Model Y is in a different galaxy).

In the lower half of the table, there were no position changes, but we should highlight the Ford Mustang Mach-E again. It is still in #20, but the electric crossover from America should jump a couple of positions in the coming months.

Top Selling Auto Brands

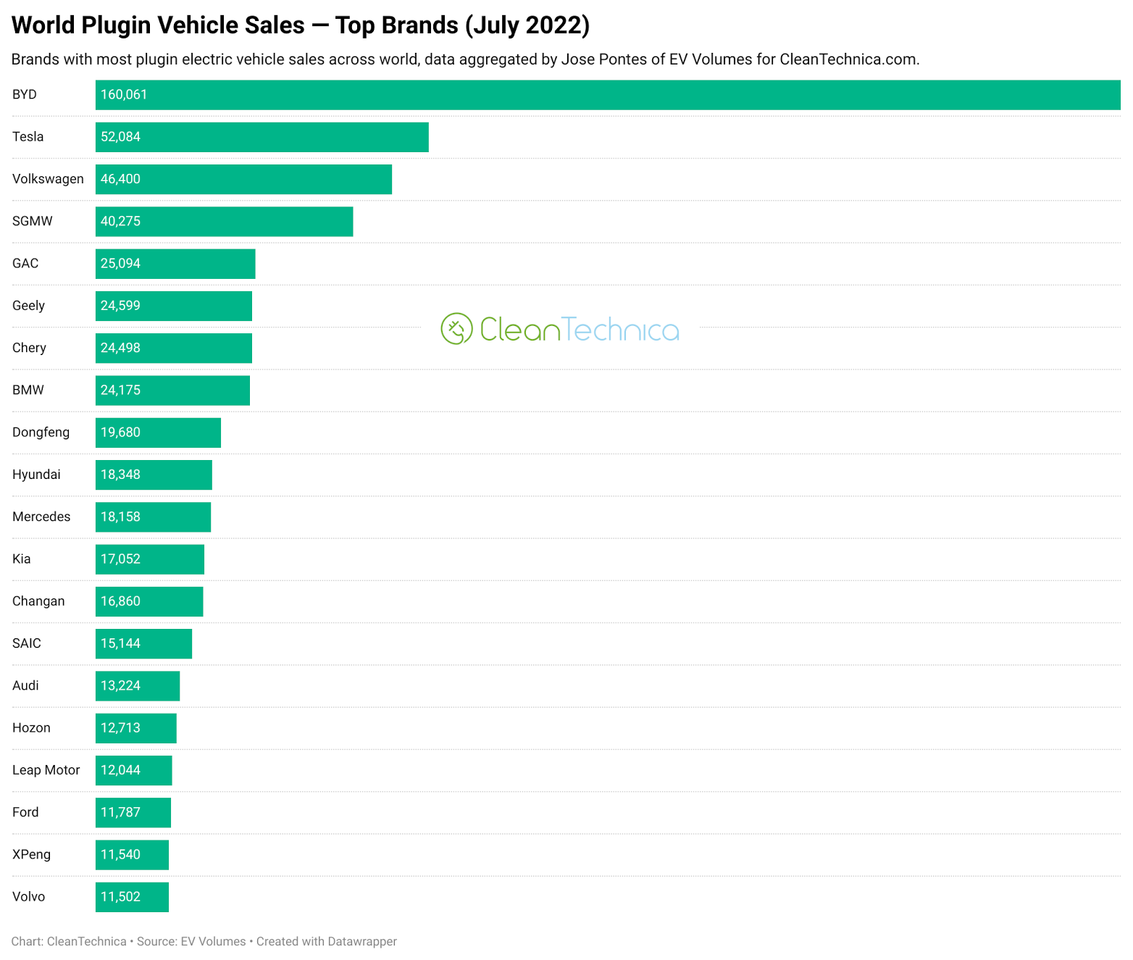

The Rise and Rise of BYD

Volkswagen confirmed its return to form by scoring 46,400 registrations, allowing it to surpass SMGW and end the month in the last place on the podium.

Off the podium, we had six record performances, five of which came from Chinese legacy OEMs. In #5, we have GAC, benefitting from the popularity of the Aion lineup with a record 25,094 registrations. In #6, the surging Geely reached 24,599 units, and should go above 30,000 units soon. In #7, there’s Chery taking profit from its eQ1/QQ Ice Cream dynamic duo. In #9, it’s Dongfeng, which thanks to the Fengshen E-Series and the rest of its looong lineup has seen its sales jump. In #13, we have Changan, now starting to benefit from the production ramp-up of the little Lumin (3,100 registrations last month), which releases part of the weight from the best selling Benni EV’s shoulders.

Leap Motor was the other record breaker in July, thanks to the strong performances of its T03 and C11 models. It achieved 12,044 registrations last month. Expect the startup to become a familiar face in this top 20.

Other brands joining the best seller table were #18 Ford and #20 Volvo. With Geely going after Volkswagen (first) and BYD (later), it’s up to the Swedish brand to face off against Audi, Mercedes, and BMW in the race for the best selling premium brand.

In the YTD table, the top two position holders are in a different galaxy. Both are competing for #1, but BYD is now the clear favorite.

And even if BYD ends up losing to Tesla, it will be the first time since 2018 that anyone has been able to challenge Tesla’s dominance of the market, which can only be described as a positive development towards a more mature market.

Below these two, the SGMW joint venture is comfortable in 3rd, despite having lost some ground to #4 Volkswagen. The stage is set, though, for the Wolfsburg brand to go after SGMW in the second half of the year to try to recover the last place on the podium.

The first position change took place in #7, where Chery jumped two positions. The Chinese brand is now looking to catch #6 Mercedes. Still in the first half of the table, GAC is now #10, with the maker of the Aion model series surely trying to gain a couple more positions in the coming months.

Looking at the remaining top 20, the highlights were rising Dongfeng and Geely climbing to #13 and #15, respectively, with Geely expected to climb a few more positions in the coming months.

Still on the topic of the top 20, we have Hozon joining the top 20, in #18. That was at the expense of Ford, which is now in #21 with 75,888 units, only 51 units behind #20 Great Wall. Hozon has become the 11th Chinese brand on the table!

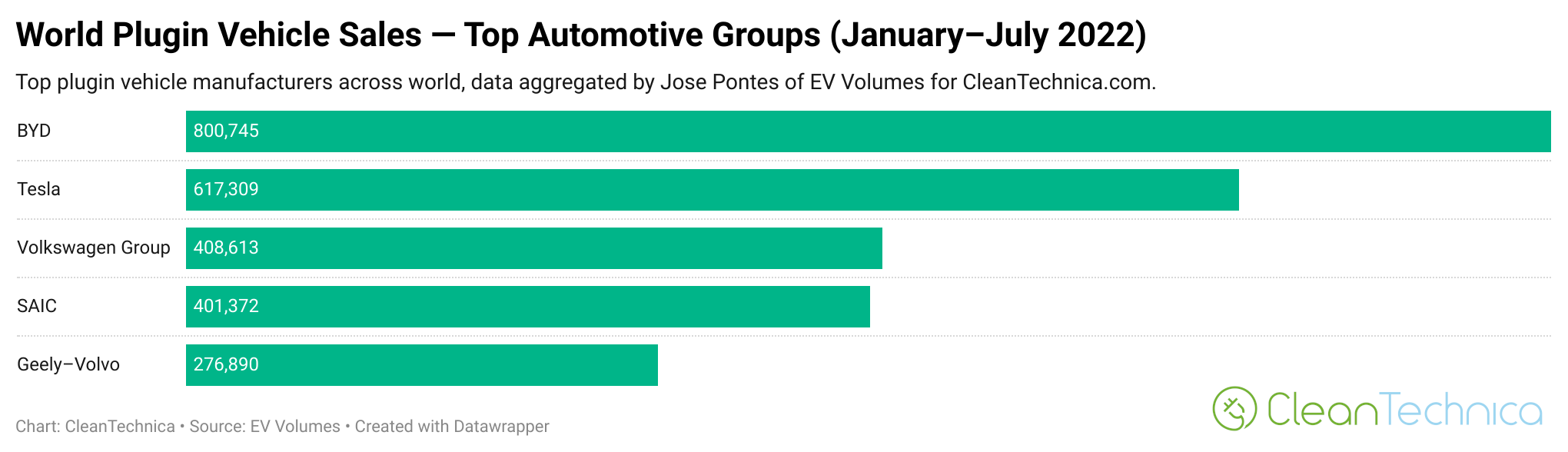

Top Selling Auto Groups

Let’s look at registrations by OEM. BYD reinforced its lead by gaining 0.8% share, going up to 16.2%, while Tesla lost 1.1% share, dropping to 12.5%.

The surprise came in 3rd, with Volkswagen Group (8.3%, up 0.3%) surpassing SAIC (8.1%, down 0.5%). The German conglomerate returned to the podium with this move, and is now hoping to reach the sales level of the top two. (Good luck.)

Geely–Volvo (5.6%) remained in 5th, while Hyundai–Kia (5.4%) surpassed Stellantis (5.4%, down 0.1%) to become the new #6.

SAIC’s drop is mostly due to the fact that it lacks other successful models besides the little Wuling Mini EV. Unlike most Chinese OEMs that are strong in their domestic market but almost nonexistent elsewhere, SAIC is the most successful Chinese automaker outside China. It has significant export volumes thanks to the success of the MG brand, but on the other hand, it is basically a one-trick pony in its home market of China, living off the success of the Wuling Mini EV. Maybe the upcoming MG 4/Mulan will change that?

One thing is certain: from the current top 5 OEMs, SAIC is the one with the most potential to lose share in the remainder of the year.