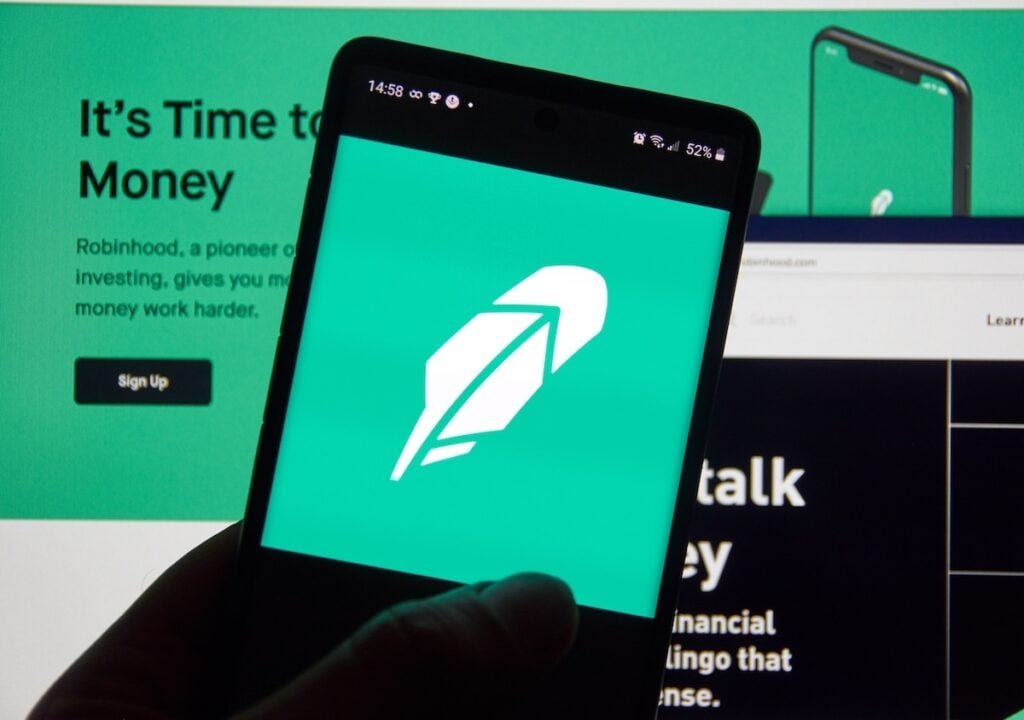

Robinhood Positions Itself to Support Trump Accounts Initiative After CEO Assurances to White House

Robinhood CEO Vlad Tenev says the fintech firm can deliver robust technology for the Trump Accounts program as it vies for a leading role in managing the new federal savings plan

Robinhood Markets has signalled its readiness to play a central role in the Trump administration’s nascent “Trump Accounts” savings initiative after Chief Executive Officer Vlad Tenev personally assured President Donald Trump and Treasury officials that the company can provide the technology and operational capacity needed to make the program robust and intuitive.

During discussions late last year, Tenev conveyed that Robinhood’s platform and engineering resources could support millions of accounts that the federal scheme is expected to generate for American children born between 2025 and 2028, emphasising the importance of early financial engagement and market participation.

The Trump Accounts concept, part of broader Republican-led legislative efforts, would see the U.S. government seed a tax-deferred investment account with a one-time contribution of one thousand dollars for each eligible newborn, with parents and guardians able to add further contributions up to a specified limit.

Tenev has framed the initiative as aligning with Robinhood’s mission to democratise finance and “get people from a young age to buy into our free market system and be owners of America,” remarks that underscore the company’s strategic interest in the program.

At the same time, other major financial institutions are reported to be in contention for key roles in managing or administering the accounts, including Charles Schwab, JPMorgan Chase, Wells Fargo and asset manager BlackRock, as the Treasury considers how to allocate the responsibilities.

Robinhood has already signalled its support by agreeing to match the federal one thousand dollar contribution for the children of its own employees, and its shares have shown positive market reaction amid speculation about its potential selection.

The initiative, which also has garnered commitments from philanthropists and corporate donors to support supplemental funding, remains subject to ongoing legislative and regulatory processes, with the final framework for implementation yet to be determined.

During discussions late last year, Tenev conveyed that Robinhood’s platform and engineering resources could support millions of accounts that the federal scheme is expected to generate for American children born between 2025 and 2028, emphasising the importance of early financial engagement and market participation.

The Trump Accounts concept, part of broader Republican-led legislative efforts, would see the U.S. government seed a tax-deferred investment account with a one-time contribution of one thousand dollars for each eligible newborn, with parents and guardians able to add further contributions up to a specified limit.

Tenev has framed the initiative as aligning with Robinhood’s mission to democratise finance and “get people from a young age to buy into our free market system and be owners of America,” remarks that underscore the company’s strategic interest in the program.

At the same time, other major financial institutions are reported to be in contention for key roles in managing or administering the accounts, including Charles Schwab, JPMorgan Chase, Wells Fargo and asset manager BlackRock, as the Treasury considers how to allocate the responsibilities.

Robinhood has already signalled its support by agreeing to match the federal one thousand dollar contribution for the children of its own employees, and its shares have shown positive market reaction amid speculation about its potential selection.

The initiative, which also has garnered commitments from philanthropists and corporate donors to support supplemental funding, remains subject to ongoing legislative and regulatory processes, with the final framework for implementation yet to be determined.